World News

The Stock Market Is Doing Something Unseen Since the Year 2000. History Says This Happens Next.

The S&P 500 has been setting one new all-time high after another in 2024, but not every stock has participated during the current bull market.

Over the last few years, big tech stocks have been the driving force behind the stock market’s increasing value. That trend accelerated recently as innovations among the biggest companies using artificial intelligence (AI) have pushed their stock prices even higher.

The market expects those innovators to produce massive earnings growth over the next few years, and investors have raised their valuations as a result.

But one indicator suggests the domination of big tech might be about to shift. Investors could find a great investment opportunity from an entirely different group of stocks.

A huge valuation gap that can’t be ignored

One of the most commonly used valuation metrics in investing is the price-to-earnings (P/E) ratio. It tells you how much you’ll pay per dollar of earnings for any given stock. For example, if a company generated $1 in earnings per share over the past year and its share price is $20, it has a P/E ratio of 20.

Since stocks are valued based on expectations for the future, looking at forward P/E can be a better indicator of whether a stock is fairly priced. The forward P/E uses management or analysts’ expectations for earnings over the next year to calculate the ratio, instead of previous earnings.

Looking at stocks as a group and comparing their valuation to historical averages can help determine whether the market as a whole is overvalued or undervalued. And comparing the P/E of one segment of the market to another could help identify investment opportunities.

Currently, the gap between the forward P/E ratios of the large-cap S&P 500 index and the small-cap S&P 600 index is about as wide as it’s been since the start of the century. As of this writing, the S&P 500 has a forward P/E of 21.3, while the S&P 600 sits at just 13.9. The last time the gap topped seven was just ahead of the dot-com recession of 2001, according to Yardeni Research.

I’m not suggesting we’re headed for another recession or a big market downturn in the near future, but it seems increasingly likely the next leg up in the market will be driven by smaller companies.

While the S&P 500 struggled to make any gains in the early 2000s, small caps zoomed higher. And history could be about to repeat itself.

The massive outperformance of small caps

Over the very long run, small caps historically outperform large caps. But that outperformance comes in cycles. Small caps underperform in some periods and then massively outperform in others.

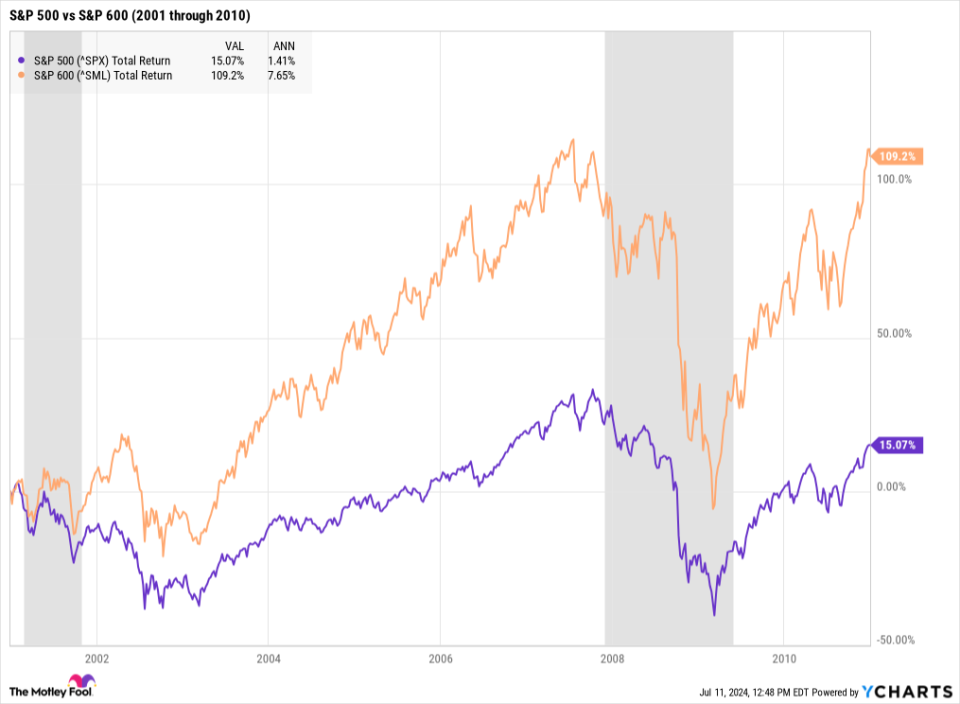

The last time the valuation gap between large-cap and small-cap stocks was this wide, the S&P 600 went on to generate huge returns for investors relative to its large-cap counterpart.

From the start of 2001 through 2005, the S&P 600 produced a total return of 66.7%, or a compound annual growth rate of 10.8%. By comparison, the S&P 500 offered just a 2.8% total return over the same five-year period.

Through 2010, which includes the Great Recession, small caps continued to outperform. The S&P 600 produced a total return of 109.2% vs 15.1% for the S&P 500.

How to invest in today’s market

There are a few reasons small-cap stocks have lagged larger companies in recent history. For one, higher interest rates in the last few years have put pressure on small caps that are heavily reliant on debt for growth.

What’s more, investors will discount future earnings more if they can get a 5% risk-free return from Treasury bonds. That’s a double whammy for small caps. On top of that, recession fears over the last couple of years pushed more investors to favor larger, more stable companies.

But smaller companies could be set to get some relief from high interest rates. The Federal Open Market Committee expects to cut interest rates at least once this year. After a couple of months with better-than-expected inflation data, the market thinks the Fed could cut rates even faster. And recession fears have abated over the past year as well.

That could make it a great time to invest in small-cap stocks. You could research individual companies to find the best opportunities among smaller stocks. These companies aren’t as widely followed — fewer analysts and institutional investors are buying and selling shares — and that means there’s a great opportunity to outperform the overall market.

But the simplest way to buy small caps is to use an index fund. You could buy the SPDR Portfolio S&P 600 Small Cap ETF (NYSEMKT: SPSM). This exchange-traded fund (ETF) does a good job of tightly tracking the benchmark index with an expense ratio of just 0.03%.

Another option is an index fund that tracks the Russell 2000, which is often used as the benchmark for small-cap stocks. It doesn’t have any profitability requirements like the S&P 600 does, so it includes a lot more growth stocks that have yet to become profitable.

While the S&P 600 has historically outperformed the Russell 2000, some big-name billionaires are buying Russell 2000 index funds like the iShares Russell 2000 ETF (NYSEMKT: IWM).

My personal favorite way to invest in small-cap stocks is with the Avantis U.S. Small Cap Value ETF (NYSEMKT: AVUV). Technically an active fund, it uses several profitability and valuation criteria to narrow down the small-cap stock universe and weigh investments across 774 stocks. The result is a mostly passive portfolio, which still keeps fees low at just 0.25%.

While there’s still a place for large caps in any portfolio, investors might want to consider using one of the above ETFs to tilt their weighting toward small caps in today’s market.

Should you invest $1,000 in SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF right now?

Before you buy stock in SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Adam Levy has positions in American Century ETF Trust-Avantis U.s. Small Cap Value ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Stock Market Is Doing Something Unseen Since the Year 2000. History Says This Happens Next. was originally published by The Motley Fool

World News

Missing California mother found dead near hiking trail after partner threatened 3-year-old daughter: police

A missing mother in Northern California was found dead near a hiking trail in the mountains on Sunday, hours after authorities say the woman’s partner threatened their 3-year-old daughter with a knife and charged at a police officer.

The body of Lizbeth Arceo Sedano, 25, was found around 9:40 a.m. near Eureka Canyon Road and Grizzly Flat Road in the Santa Cruz Mountains, the Santa Cruz County Sheriff’s Office said.

Deputies responded to the call and investigators determined the body belonged to the 25-year-old mother, who had been reported missing in Watsonville a day earlier.

Sedano’s family reported her missing after the mother’s partner, Joshua Gonzalez, called the Watsonville Police Department from outside the police station at around 9:20 p.m. Saturday and threatened to harm their 3-year-old daughter, the department said.

IDAHO 5-YEAR-OLD FOUND DEAD AFTER WANDERING AWAY FROM HIS BIRTHDAY PARTY: POLICE

Sedano’s body was found around 9:40 a.m. Sunday near Eureka Canyon Road and Grizzly Flat Road in the Santa Cruz Mountains. (Santa Cruz County Sheriff’s Office)

A responding officer exited his patrol car and ordered Gonzalez to drop the knife. Gonzalez ignored the officer’s command, according to police, and instead charged toward the officer.

The death of 25-year-old Lizbeth Arceo Sedano is being investigated as suspicious, the sheriff’s office said. (Watsonville Police Department)

The officer then opened fire on Gonzalez, who was injured and taken to an out-of-county trauma center, where he is in stable condition, police said.

Sedano’s partner, Joshua Gonzalez, was taken into custody after threatening to harm their 3-year-old daughter with a knife and charging at a police officer, mere hours before Sedano’s body was found, authorities said. (Watsonville Police Department)

The three-year-old child was unharmed and was under the care of family members.

TEXAS FAMILY MISSING ON ALASKA VACATION AFTER BOAT CAPSIZES OFF COAST

The sheriff’s office said Sedano’s death “is being investigated as suspicious.”

“Cause and manner will be determined by our Forensic Pathologist and detectives will continue to investigate this case,” the sheriff’s office said.

World News

Government concerned by immigration lawyer ‘hitlist’

The government says social media platforms “clearly need to do far more” after it emerged a list purporting to contain the names and addresses of immigration lawyers was being spread online.

Initially shared on the Telegram messaging app – along with the phrase “no more immigration” – it has now begun appearing on other platforms.

Lawyers have told the BBC they have been advised by police to work from home, board up office windows and install fireproof letterboxes.

Jim McMahon, minister for Housing, Communities and Local Government, told the Today programme, on BBC Radio 4, that he was “concerned”.

The Law Society of England and Wales said it was treating the list as a “very credible threat” to its members.

“This week has been a stark reminder that the anti-lawyer rhetoric has very real-world consequences for solicitors working tirelessly for their clients, access to justice and the rule of law,” said its president Nick Emmerson.

“We don’t know if they will transpire to be protests like we’ve seen in other places or whether it’s a list that’s intended just to cause alarm and distress or even to provoke,” Mr McMahon said.

“But to be clear we are absolutely prepared in terms of our policing response, in terms of our prosecutor response, and also in terms of our court response.”

The BBC has approached Telegram for comment on the spreading of the list – it is yet to respond.

However, in a previous statement about the unrest it said its moderators were “actively monitoring the situation and are removing channels and posts containing calls to violence.”

It said such “calls to violence” were explicitly forbidden in its terms of service.

Mr McMahon warned people could “expect the full force of the law” if they “cross the line”, whether it is “on the street or online”.

The Telegram group was created just hours after the killing of three children at a holiday club in Southport, on Merseyside, on 29 July.

That triggered waves of unrest in England and Northern Ireland, partly fuelled by far-right activists and online misinformation.

One immigration lawyer on the list told the BBC she had been repeatedly threatened, and received messages on Monday telling her she was “on a hitlist”.

Mr McMahon would not be drawn on whether Telegram could be told to remove channels where the list is being spread, or whether the messaging app could be blocked altogether.

He said it was important that police and prosecutors were able to do their jobs “without any political interference”.

Mark Webster, the chief constable of Cleveland Police, told Today people should be “very careful” about “naming individual premises or saying what we’re doing individually in forces”.

“You will see an awful lot of resource today and over the following days to make sure we can manage responses to all of the intelligence that comes in,” he said.

He urged people to focus on official communications online, and not to “react to things on social media from sources you can’t verify”.

World News

California earthquake: Magnitude 5.2 quake rattles SoCal

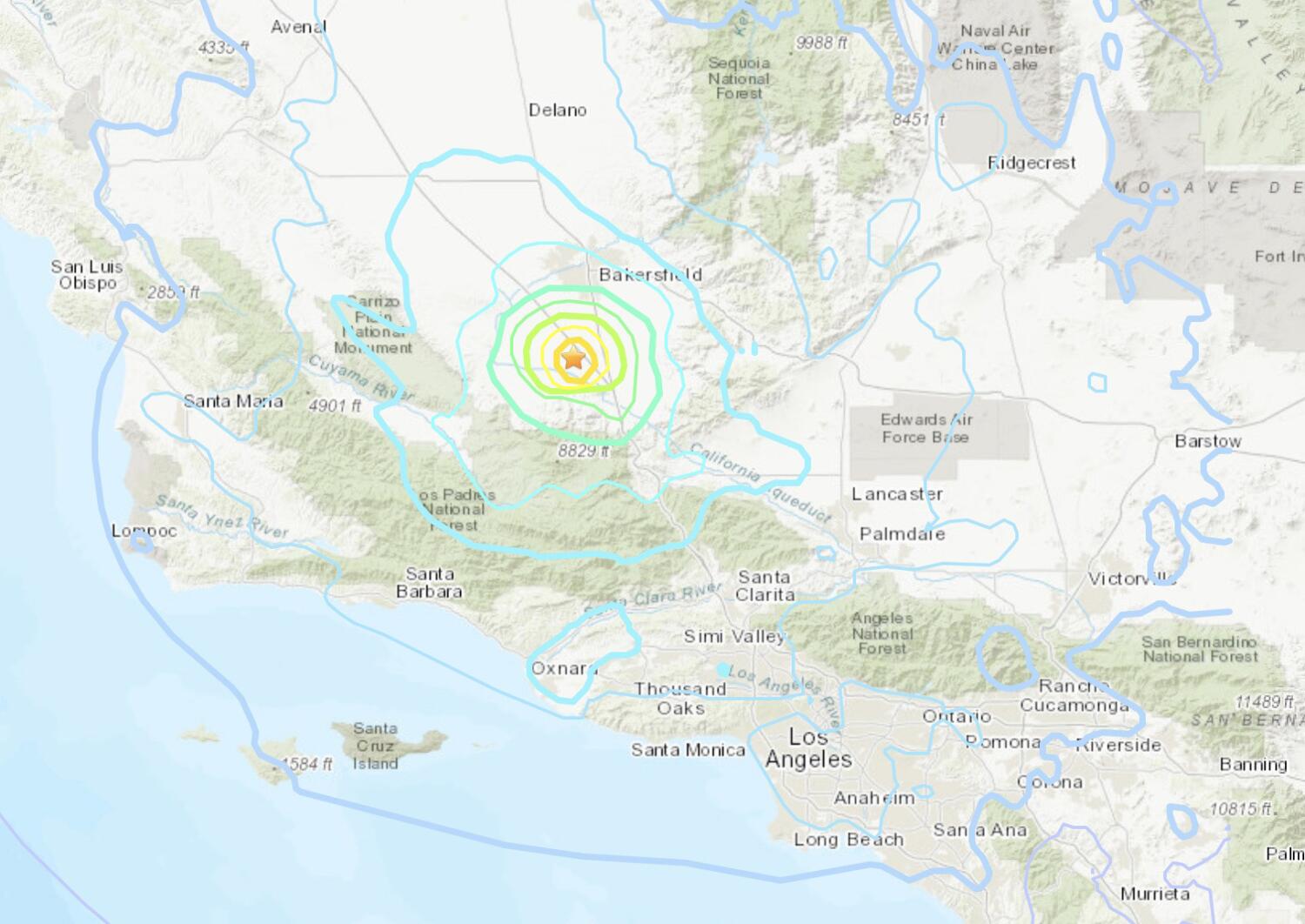

A magnitude 5.2 earthquake, centered about 18 miles southwest of Bakersfield, was felt across a wide swath of Southern California on Tuesday night.

The earthquake, originally estimated at magnitude 5.3, struck at 9:09 p.m., according to the U.S. Geological Survey. It was followed by dozens of aftershocks of magnitude 2.5 and up, including a magnitude 4.5 earthquake that occurred less than a minute after the first, and a magnitude 4.1 temblor at 9:17 p.m.

The epicenter was in sparsely populated farmland, about 14 miles northwest of the unincorporated community of Grapevine in Kern County, 60 miles northwest of Santa Clarita, and about 88 miles northwest of downtown Los Angeles.

Two minutes after the earthquake hit, a large boulder — the size of an SUV — was reported blocking multiple southbound lanes of Interstate 5, about a mile south of Grapevine Road, the California Highway Patrol said. The boulder was still blocking lanes of traffic at least an hour after the earthquake.

The area closest to the epicenter felt “very strong” shaking as defined by the Modified Mercalli Intensity Scale; that zone includes a section of the California Aqueduct, which transports water from Northern California to Southern California.

By the time shaking was felt in more populated areas, including Bakersfield, Santa Clarita and Ventura, the USGS calculated that only “weak” shaking was felt, which can rock standing cars and cause vibrations in a building similar to the passing of a truck.

Some residents affected by the quake reported an extended period of shaking. One person in Los Feliz felt 45 seconds of movement, with at least three different waves — one weak, followed by a strong one, then again a weak one. In South Pasadena and Whittier, people felt about 20 seconds of shaking, contained in two distinctive waves.

In Pasadena, seismologist Lucy Jones said she felt about three seconds of shaking.

There were no immediate reports of damage. And not everyone felt the earthquake. L.A. County Sheriff’s Deputy Jose Gomez said he didn’t feel the shaking during his drive into work at the sheriff’s Santa Clarita station. No damage was reported there.

The Los Angeles Fire Department said no significant damage was reported within city limits.

The USGS said the quake was felt across the Los Angeles Basin and inland valleys and in Santa Maria, Bakersfield and Fresno.

Many Southern California residents described getting alerts from the USGS’ earthquake early warning system, such as through the MyShake app or on their Android phones. (The earthquake early warning system is automatically installed on Android phones, but people with Apple iOS phones need to install the MyShake app to get the most timely alerts.)

One person described getting 30 to 45 seconds of warning before feeling the shaking arrive. Another person, in east Anaheim, reported 30 seconds of warning before shaking arrived.

Jones, a research associate at Caltech, said the duration of shaking can vary so much in the L.A. area because the length of time the earth moves at any given spot can depend on the soil and rocks beneath the location, whether a person is sitting still or moving around, and even whether an individual is on the ground floor or on top of a skyscraper — those on higher floors feel the shaking more strongly.

The reason some people may have felt more than one wave of shaking is that the first aftershock occurred so soon — less than a minute — after the main shock, Jones said.

Geophysics professor Allen Husker, head of the Southern California Seismic Network at Caltech, said it wasn’t surprising that so many people in the L.A. area felt significant shaking from a magnitude 5.2 earthquake north of the Grapevine. The temblor occurred at night, when people are resting and more likely to feel shaking from a distant quake than if they were out and about during the day and active.

Another reason many people felt substantial movement is due to the way shaking is amplified in the Los Angeles Basin. The basin is a 6-mile-deep, bathtub-shaped hole in the underlying bedrock filled with weak sand and gravel eroded from the mountains and forming the flat land where millions of people live. It stretches from Beverly Hills through southeast L.A. County and into northern Orange County.

“The basin effect … increases the shaking that you would otherwise normally have,” Husker said.

The effect happens when waves from the shaking arrive and hit the walls of the basin, then bounce back at the walls of the basin, Jones said, resulting in an “extended duration.”

A major earthquake on the San Andreas fault would result in perhaps 50 seconds of strong shaking in downtown L.A. “This earthquake was much, much smaller, of course,” Jones said, “but it was large enough to set up some of these basin effects and get things bouncing around.”

As with all earthquakes, there was a 1 in 20 chance that Tuesday’s temblor was a foreshock to a larger earthquake. The risk that a follow-up quake will be larger diminishes over time.

In the last 10 days, there had been no earthquakes of magnitude 3.0 or greater centered nearby.

An average of five earthquakes with magnitudes of 5.0 to 6.0 occur per year in California and Nevada, according to a recent three-year data sample.

Tuesday’s earthquake occurred about 12 miles northwest of the epicenter of the magnitude 7.5 Kern County earthquake that struck on July 21, 1952. That earthquake resulted in 12 deaths, and, according to the USGS, old and poorly built masonry buildings suffered damage. Some of those structures collapsed in communities including Tehachapi, Bakersfield and Arvin; heavy damage was reported at Kern County General Hospital.

Shaking from the 1952 earthquake was felt as far away as San Francisco and Las Vegas, and caused nonstructural but extensive damage to tall buildings in the Los Angeles area and damage to at least one building in San Diego, according to the USGS.

The 1952 earthquake occurred on the White Wolf fault. Tuesday’s earthquake wasn’t associated with any previously mapped faults.

The earthquake occurred at a depth of 5.6 miles. Did you feel this earthquake? Consider reporting what you felt to the USGS.

Find out what to do before, and during, an earthquake near you by signing up for our Unshaken newsletter, which breaks down emergency preparedness into bite-sized steps over six weeks. Learn more about earthquake kits, which apps you need, Lucy Jones’ most important advice and more at latimes.com/Unshaken.

The first version of this story was automatically generated by Quakebot, a computer application that monitors the latest earthquakes detected by the USGS. A Times editor reviewed the post before it was published. If you’re interested in learning more about the system, visit our list of frequently asked questions.

Times staff writers Jon Healey, Ian James, Jason Neubert, Sandra McDonald and Raul Roa contributed to this report.

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History7 months ago

African History7 months agoBlack History Facts I had to Learn on My Own pt.6 📜

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History1 year ago

African History1 year agoMajor African Tribes taken away during the Atlantic Slave Trade🌍 #slavetrade #africanamericanhistory

-

African History1 year ago

African History1 year agoCameroon 🇨🇲 World Cup History (1962-2022) #football #realmadrid #shorts

-

African History1 year ago

African History1 year agoWhat did Columbus Find in 1493? 🤯🔥🔥 #history #civilization #mesoamerica #africa #kemet

-

African History7 months ago

African History7 months agoBlack History Inventors: Mary Kenner 🩸

-

African History1 year ago

African History1 year agoNo African pre-Columbus DNA? 🤯🤯 #history #mesoamerica #mexico #african