World News

The Stock Market Is Doing Something Unseen Since the Year 2000. History Says This Happens Next.

The S&P 500 has been setting one new all-time high after another in 2024, but not every stock has participated during the current bull market.

Over the last few years, big tech stocks have been the driving force behind the stock market’s increasing value. That trend accelerated recently as innovations among the biggest companies using artificial intelligence (AI) have pushed their stock prices even higher.

The market expects those innovators to produce massive earnings growth over the next few years, and investors have raised their valuations as a result.

But one indicator suggests the domination of big tech might be about to shift. Investors could find a great investment opportunity from an entirely different group of stocks.

A huge valuation gap that can’t be ignored

One of the most commonly used valuation metrics in investing is the price-to-earnings (P/E) ratio. It tells you how much you’ll pay per dollar of earnings for any given stock. For example, if a company generated $1 in earnings per share over the past year and its share price is $20, it has a P/E ratio of 20.

Since stocks are valued based on expectations for the future, looking at forward P/E can be a better indicator of whether a stock is fairly priced. The forward P/E uses management or analysts’ expectations for earnings over the next year to calculate the ratio, instead of previous earnings.

Looking at stocks as a group and comparing their valuation to historical averages can help determine whether the market as a whole is overvalued or undervalued. And comparing the P/E of one segment of the market to another could help identify investment opportunities.

Currently, the gap between the forward P/E ratios of the large-cap S&P 500 index and the small-cap S&P 600 index is about as wide as it’s been since the start of the century. As of this writing, the S&P 500 has a forward P/E of 21.3, while the S&P 600 sits at just 13.9. The last time the gap topped seven was just ahead of the dot-com recession of 2001, according to Yardeni Research.

I’m not suggesting we’re headed for another recession or a big market downturn in the near future, but it seems increasingly likely the next leg up in the market will be driven by smaller companies.

While the S&P 500 struggled to make any gains in the early 2000s, small caps zoomed higher. And history could be about to repeat itself.

The massive outperformance of small caps

Over the very long run, small caps historically outperform large caps. But that outperformance comes in cycles. Small caps underperform in some periods and then massively outperform in others.

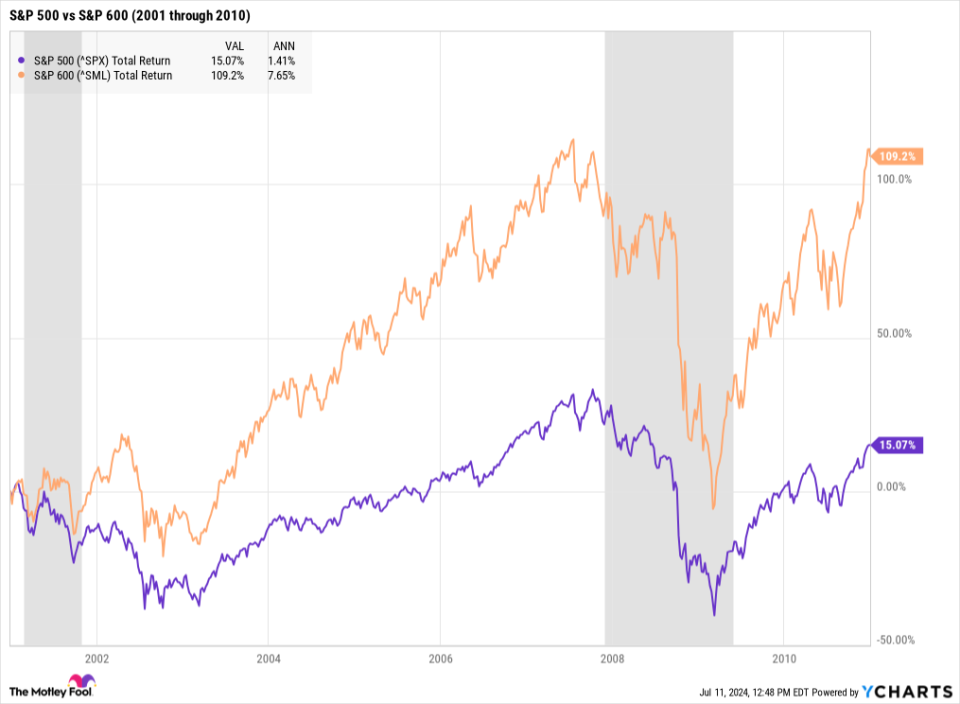

The last time the valuation gap between large-cap and small-cap stocks was this wide, the S&P 600 went on to generate huge returns for investors relative to its large-cap counterpart.

From the start of 2001 through 2005, the S&P 600 produced a total return of 66.7%, or a compound annual growth rate of 10.8%. By comparison, the S&P 500 offered just a 2.8% total return over the same five-year period.

Through 2010, which includes the Great Recession, small caps continued to outperform. The S&P 600 produced a total return of 109.2% vs 15.1% for the S&P 500.

How to invest in today’s market

There are a few reasons small-cap stocks have lagged larger companies in recent history. For one, higher interest rates in the last few years have put pressure on small caps that are heavily reliant on debt for growth.

What’s more, investors will discount future earnings more if they can get a 5% risk-free return from Treasury bonds. That’s a double whammy for small caps. On top of that, recession fears over the last couple of years pushed more investors to favor larger, more stable companies.

But smaller companies could be set to get some relief from high interest rates. The Federal Open Market Committee expects to cut interest rates at least once this year. After a couple of months with better-than-expected inflation data, the market thinks the Fed could cut rates even faster. And recession fears have abated over the past year as well.

That could make it a great time to invest in small-cap stocks. You could research individual companies to find the best opportunities among smaller stocks. These companies aren’t as widely followed — fewer analysts and institutional investors are buying and selling shares — and that means there’s a great opportunity to outperform the overall market.

But the simplest way to buy small caps is to use an index fund. You could buy the SPDR Portfolio S&P 600 Small Cap ETF (NYSEMKT: SPSM). This exchange-traded fund (ETF) does a good job of tightly tracking the benchmark index with an expense ratio of just 0.03%.

Another option is an index fund that tracks the Russell 2000, which is often used as the benchmark for small-cap stocks. It doesn’t have any profitability requirements like the S&P 600 does, so it includes a lot more growth stocks that have yet to become profitable.

While the S&P 600 has historically outperformed the Russell 2000, some big-name billionaires are buying Russell 2000 index funds like the iShares Russell 2000 ETF (NYSEMKT: IWM).

My personal favorite way to invest in small-cap stocks is with the Avantis U.S. Small Cap Value ETF (NYSEMKT: AVUV). Technically an active fund, it uses several profitability and valuation criteria to narrow down the small-cap stock universe and weigh investments across 774 stocks. The result is a mostly passive portfolio, which still keeps fees low at just 0.25%.

While there’s still a place for large caps in any portfolio, investors might want to consider using one of the above ETFs to tilt their weighting toward small caps in today’s market.

Should you invest $1,000 in SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF right now?

Before you buy stock in SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR Series Trust – SPDR Portfolio S&P 600 Small Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Adam Levy has positions in American Century ETF Trust-Avantis U.s. Small Cap Value ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Stock Market Is Doing Something Unseen Since the Year 2000. History Says This Happens Next. was originally published by The Motley Fool

World News

‘Sherlock’ Finds Matching Usernames Across 400 Social Media Networks

Want to check if a particular internet handle you encountered online (or created yourself) is being used on any other social networks or websites? Sherlock is a free command line application that scans around 400 social networks and finds accounts that match whatever username you type in.

Using this service couldn’t be simpler: Just open it up and type “sherlock” followed by the username your want to search for. The program will check every site it can access and tell you where accounts matching your username exist, complete with a link to the relevant profile page. This is useful in two ways: finding people across multiple websites, and checking whether a username you’re thinking of using is already taken on other sites.

Find a specific user name anywhere it’s registered

The first of those use cases isn’t foolproof, of course. For one thing, some people use different handles on different websites. For another, accounts with the same name on different websites aren’t necessarily going to belong to the same person or brand (most of the accounts in the screenshot at the top of this post, for example, do not belong to Lifehacker). Still, just knowing where other accounts with the same handle exist is a great starting point if you’re curious what other sites the person you’re searching for uses regularly.

Check if your user name is taken almost anywhere

The second scenario, checking whether a handle you’re thinking of using is broadly available on the web, is possibly much more useful. Whether you’re thinking of starting a company or just toying around with a new internet handle, it’s good to know whether anyone else is already using your chosen moniker.

How to set up Sherlock on macOS, Linux, and Windows

Sherlock is useful, yes, but a little bit tricky to set up.

On a Mac, the simplest way to tackle it is to install the service using Homebrew, which makes installing and updating Mac apps much easier. After setting up Homebrew, you’ll only need to open that app and type “brew install sherlock" to install. Things are easier if you’re a Linux user: Sherlock is likely already offered by your package manager.

Things are much harder on Windows, sadly. On that system, I recommended you set up pipx for installation. This is a sort of package manager for Python scripts. The process is probably not going to be straightforward if you’re not already comfortable with the command line, but as an overview, you’ll need to install Python, then use pip to install pipx, then use pipx to install Sherlock. Yes, that’s a lot setup to use one simple tool. But once everything is set up, Sherlock couldn’t be easier to use—and it just might be worth the effort.

World News

Tyreek Hill receives 2 citations in incident involving Miami-Dade police officers

Miami Dolphins wide receiver Tyreek Hill was cited for careless driving and a seat belt violation during his traffic stop before Sunday’s game against the Jacksonville Jaguars.

The Miami-Dade Police Department released the citations on Tuesday – one day after bodycam footage showed the intense moment the NFL player was pulled over, taken out of his vehicle and handcuffed while on the ground.

CLICK HERE FOR MORE SPORTS COVERAGE ON FOXNEWS.COM

Miami Dolphins wide receiver Tyreek Hill before the game against the Jacksonville Jaguars at Hard Rock Stadium. (Sam Navarro-Imagn Images)

Hill was found to be in violation of Florida statute 316.1925, which defines careless driving as “any person operating a vehicle upon the streets or highways within the state shall drive the same in a careful and prudent manner, having regard for the width, grade, curves, corners, traffic, and all other attendant circumstances, so as not to endanger the life, limb, or property of any person. Failure to drive in such manner shall constitute careless driving and a violation of this section.”

Police said Hill was driving at a “visual estimation (of) 60 mph” in a 40 mph zone with no seat belt.

DOLPHINS’ TYREEK HILL NOT BLAMELESS IN INCIDENT WITH POLICE OFFICERS, ESPN’S STEPHEN A SMITH SAYS

Dolphins wide receiver Tyreek Hill speaks during the postgame news conference, Sunday, Sept. 8, 2024, in Miami Gardens, Florida. (AP Photo/Rebecca Blackwell)

Hill was briefly detained during the traffic stop after an intense back and forth with officers. Calais Campbell and Jonnu Smith were also given citations during the incident. They pulled over to see if Hill was OK during the incident, according to bodycam footage.

Manuel Morales, the chief of police for the Miami Police Department, released a statement on the incident.

Dolphins head coach Mike McDaniel talks to wide receiver Tyreek Hill before the Jacksonville Jaguars game, Sunday, Sept. 8, 2024, in Miami Gardens, Florida. (AP Photo/Rebecca Blackwell)

CLICK HERE TO GET THE FOX NEWS APP

“The body-worn camera depicting the interaction between members of the Miami Dade Police and Mr. Hill is hard to watch, but it’s a reminder that we must always strive to do better,” Morales said. “Despite no city of Miami Police involvement, I pray we can move forward and use this incident to forge a stronger partnership between our professional athletes, the community, and the brave men and women who are sworn to protect us all. When we work together, we all win.”

Follow Fox News Digital’s sports coverage on X and subscribe to the Fox News Sports Huddle newsletter.

World News

Winter fuel cuts to go ahead after government wins Commons vote

Winter fuel payments are set to end for millions of pensioners this year after an attempt to block the cuts failed.

The Conservatives tabled a motion to halt the government’s plan to restrict the payments to all but the poorest pensioners but it was rejected by 348 to 228 votes – a majority of 120.

Dozens of Labour MPs were reported to have been planning to abstain in protest at the cuts despite Chancellor Rachel Reeves urging them to back her decision.

In the end, 52 MPs did not take part in the vote, including some Labour ministers, but it is not yet known how many had deliberately abstained or were absent from Parliament for another reason.

Shouts of “shame” were heard in the Commons chamber as the result was announced, which will mean the number of fuel payments will fall from 11.4 million to 1.5 million this winter.

The payments of either £200 or £300 are normally made in November and December and will still be paid to all pensioners claiming pension credit to top up a low income.

Sir Keir Starmer told the BBC’s Laura Kuenssberg that the impact on the 10m pensioners losing out would be lessened by the fact pensions are rising by 4% in April, increasing the full state pension by £460 a year.

However, pension payments are made throughout the year, rather than in a lump sum like winter fuel payments, and are not intended to only cover heating costs.

During the debate, Conservative shadow work and pensions secretary Mel Stride said Labour made no mention of cutting fuel payments during the election campaign.

“Broken promises already, that special contract that they sought to have with the British people based on integrity and decency smashed into a million pieces,” he said.

He added the Labour government had “caved in to its trade union paymasters” with above-inflation pay settlements for striking workers made “on the backs of vulnerable pensioners”.

But Work and Pensions Secretary Liz Kendall accused the Conservatives of “faux outrage” and blamed them for leaving 880,000 pensioners eligible for benefits out in the cold.

To loud cheers, she said the Tories “never took the action needed to increase pension credit uptake” and accused them of playing “fast and loose with the public finances”.

But veteran Tory MP Sir Edward Leigh described the decision as “a punishment beating” and said Labour’s claims about the previous government’s financial decisions were “absolute and complete rubbish”.

Sir Edward said pensioners on the cusp of the pension credit eligibility threshold were still “looking after every penny” and would now lose winter fuel payments too.

Only one Labour backbencher, Jon Trickett, voted against the government, posting on X that he feared the measure would cause more pensioners to fall into poverty during the winter.

Mr Trickett, who was a shadow cabinet member during Jeremy Corbyn’s leadership, said this winter will be “extremely difficult” for his constituents, “even be a matter of life and death”, and accused energy companies of continuing “obscene profiteering”.

He posted: “In my view the government should be looking to raise revenues from the wealthiest in society, not working class pensioners.”

It is difficult to tell how many Labour MPs who did not vote on the winter fuel allowance actively abstained.

MPs can be absent for a number of reasons, such as travel, medical appointments, or official meetings.

They can receive ‘slips’ – or permission – from the party whips to miss the vote, or be ‘paired’ with someone from the opposing side who also agrees not to vote in order to nullify the effect of their absence.

A Labour source is claiming that only a dozen of the MPs who did not vote on scrapping the winter fuel allowance for most pensioners were “not authorised”.

Labour suggest the numbers not present in the vote are typical and say the average number of Labour MPs absent is 51.

The change is expected to shave £1.4bn from the welfare bill this year, as a step towards filling the £22bn “black hole” Ms Reeves says the government inherited from the Conservatives.

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History8 months ago

African History8 months agoBlack History Facts I had to Learn on My Own pt.6 📜

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History1 year ago

African History1 year agoMajor African Tribes taken away during the Atlantic Slave Trade🌍 #slavetrade #africanamericanhistory

-

African History1 year ago

African History1 year agoCameroon 🇨🇲 World Cup History (1962-2022) #football #realmadrid #shorts

-

African History1 year ago

African History1 year agoWhat did Columbus Find in 1493? 🤯🔥🔥 #history #civilization #mesoamerica #africa #kemet

-

African History7 months ago

African History7 months agoBlack History Inventors: Mary Kenner 🩸

-

African History1 year ago

African History1 year agoOrigin Of ‘Cameroon’ 🇨🇲😳#africa