Business

Upgrades for Best Buy and Lululemon By Investing.com

Investing.com — Here is your Pro Recap of the top takeaways from Wall Street analysts for the past week: upgrades for Best Buy , Lululemon and Collegium Pharma; downgrade for Maxeon Solar and Medifast.

InvestingPro subscribers always get first dibs on market-moving rating changes.

Best Buy

What happened? On Monday, Citi double upgraded Best Buy (NYSE:) to Buy with a $100 price target.

What’s the full story? Citi is double upgrading BBY shares from Sell to Buy. The research team believes that the catalyst path looks positive from here with upside potential to both earnings and valuation. This is based on tech replacement cycles underway, new AI innovation providing incremental demand, and margin execution remaining solid.

Last week’s 1QF25 earnings print proved GM execution remains best-in-class with company specific drivers able to offset external pressures like higher promotional activity. Simply put, that was a thesis changer versus Citi’s prior negative thesis. The research team acknowledges 2H SSS risk in the face of consumer uncertainty (election distraction and shortened holiday calendar).

However, Citi believes it’s prudent to look at the multi-year opportunity ahead as the business returns to growth and an attractive margin expansion story develops. The research team is raising their TP to $100 (from $67) based on higher EPS estimates (sales & margin led) and a raised target multiple of 14x FY26 EPS.

Buy at Citi means “Buy (1) ETR of 15% or more or 25% or more for High risk stocks.”

How did the stock react? Best Buy opened the regular session at $85.96 and closed at $86.94, a gain of 2.50% from the prior day’s regular close.

Maxeon Solar Technologies

What happened? On Tuesday, Goldman Sachs double downgraded Maxeon Solar Technologies Ltd (NASDAQ:) to Sell with a $1 price target

What’s the full story? Goldman Sachs has revised its stance on MAXN following the company’s earnings report for 4Q23 and 1Q24, released on May 30. The report showed that both gross margins and EBITDA fell short of GSe/Factset consensus expectations, leading to a weaker-than-anticipated guidance for 2Q24 and the full year of 2024. Additionally, MAXN has yet to secure the DOE loan, and in a surprising move, announced an equity investment from TZE. This investment, coupled with a debt restructuring plan, is expected to significantly alter MAXN’s capital structure. The proposed issuance of new shares is likely to dilute the value for current shareholders, with TZE’s ownership set to exceed 50.1% post-transaction, and nearly 350 million convertible shares becoming active.

The research team at Goldman Sachs points out that while the equity investment and debt restructuring should mitigate liquidity concerns amid challenging market conditions, there remains increased uncertainty regarding future funding, including the DOE loan guarantee. Given the combination of market weakness, soft guidance, risks associated with future capacity additions and timing, as well as the uncertainty and potential dilution risk of the capital structure as MAXN addresses its liquidity issues, Goldman Sachs has downgraded MAXN from Buy to Sell. The firm has also adjusted its 12-month target price for MAXN to $1, which represents a 46% downside, in contrast to the approximately 22% upside previously projected across its coverage.

Sell at Goldman means “Being assigned a Buy or Sell on an Investment List is determined by a stock’s total return potential relative to its coverage universe.”

How did the stock react? Maxeon Solar Technologies opened the regular session at $1.76 and closed at $1.75, a decline of 5.41% from the prior day’s regular close.

Medifast

What happened? On Wednesday, DA Davidson downgraded Medifast (NYSE:) to Underperform with $17.50 price target

What’s the full story? The downgrade follows a meeting with Medifast, which prompted a shift in revenue projections—now expecting a sequential flattening in the first quarter of 2025 instead of the fourth quarter of 2024. Consequently, estimated sales for 2025 have decreased by 5% year-over-year, and the projected earnings per share (EPS) have been cut by 29%.

Medifast’s advertising campaign for its GLP-1 offering, initially scheduled for June, has been delayed to July. The impact of these ads on customer acquisition won’t be disclosed until November. With the stock down 64% year-to-date, DA Davidson suggests the possibility of further decline. Medifast’s current marketing spend (5%-6% of sales) is notably lower than that of weight loss and telehealth competitors (25%-50% of sales), raising concerns about its competitive position

Underperform at DA Davidson means “Expected to lose value of over 15% on a risk adjusted basis over the next 12-18 months.”

How did the stock react? Medifast opened the regular session at $20.43 and closed at $22.02, a decline of 8.30% from the prior day’s regular close.

Lululemon

What happened? On Thursday, HSBC upgraded Lululemon Athletica Inc (NASDAQ:) to Buy with a $425 price target.

What’s the full story? HSBC analysts report that Lululemon experienced a remarkable stock surge but faced challenges after reaching an all-time high in January 2024. Doubts about North American growth resilience led to concerns, and the company’s March guidance missed consensus expectations—a significant departure from its consistent “beat and raise” pattern. Consequently, the stock has declined 40% year-to-date, contrasting with a more stable sporting goods sector.

While Q1 “Americas” comparable sales remained flat, some of the pain was self-inflicted due to inventory shortages in various colors and sizes, particularly in women’s products. However, global comparable sales increased by 7%, driven by strong performance in mainland China and other international markets. Although the Americas still account for 73% of group sales, the surge in international sales suggests a potential scenario where international revenue reaches half of the group’s business.

Despite limited earnings revisions, the recent multiple compression has led to what analysts consider an overly punished stock

How did the stock react? Lululemon opened the regular session at $337.23 and closed at $323.03, a gain of 4.91% from the prior day’s regular close.

Collegium Pharma

What happened? On Friday, Jefferies upgraded Collegium Pharmaceutical Inc (NASDAQ:) to Buy with a $44 price target.

What’s the full story? Jefferies has expressed a more bullish view on COLL, which is currently trading at just 4x EBITDA following the departure of the CEO. The firm believes that the risk/reward ratio skews to the upside. This optimistic view is driven by several factors. Firstly, Jefferies notes that the 2Q trends appear strong and the consensus EBITDA is likely too low. Secondly, the firm believes that the upside around LOEs (base case) is underappreciated.

Furthermore, Jefferies highlights the significant cash generation expected through 2028, predicting that net cash will eclipse the market cap in F28. As a result of these factors, the firm has upgraded COLL to a Buy with a $44 price target. This target is based on an equal weighting of 5xC25 adjusted EBITDA and a DCF analysis. Despite the recent leadership changes, Jefferies sees potential for growth and profitability in COLL’s future.

Buy at Jefferies means “Describes securities that we expect to provide a total return (price appreciation plus yield) of 15% or more within a 12-month period.”

How did the stock react? Collegium Pharma opened the regular session at $32.62 and closed at $33.19, a gain of 5.84% from the prior day’s regular close.

Business

UK polls point to a big Labour win. The party fears voter complacency

Labour leader Keir Starmer poses for photos as he visits the Vale Inn on June 27, 2024 in Macclesfield, United Kingdom. In the final week of campaigning, Labour outlined its plans to expand opportunities for young people.

Cameron Smith | Getty Images News | Getty Images

LONDON — There’s been one main narrative since the U.K.’s Conservative Prime Minister Rishi Sunak called a general election back in May — that the opposing Labour Party would win the vote with a landslide.

While voter polls may have differed in scale and methodology, the results have pointed in one direction, showing that the center-left Labour Party has around a 20-point lead on the Conservatives. Labour is on track to win around 40% of the vote while roughly 20% of the support is projected to go to the Tories, according to a Sky News poll tracker.

Reform UK, led by arch-Brexiteer Nigel Farage, is seen with 16% of the vote, after eating away at Tory support, while the Liberal Democrats are seen gaining around 11% and the Greens with 6%. The Scottish National Party is predicted to win 2.9% of the vote.

Labour candidates and leader Keir Starmer have been keen to play down the level of support that the party enjoys, fearing voter complacency and the appearance of “having it in the bag” — a stance that could prompt voter apathy and a lower turnout of supporters at the polls, or a backlash from Conservative-inclined sections of the electorate.

“The Labour Party wants to be able to be convince voters that it’s absolutely central that they turn out and vote, because otherwise the Tories will win, and the Tories are desperate for people to think that they have still got a chance, and therefore it’s worth turning up,” Britain’s top polling expert John Curtice told CNBC.

Question marks have risen in the past over the accuracy of British voter polls, with previous projections over or underestimating support for various political parties. The errors have often come about because of inadequate sampling or of factors that are harder to control, such as voters being “shy” when polled on which party they intended to support.

Labour Party leader Sir Keir Starmer speaks ahead of the U.K.’s general election on July 4, 2024.

Anthony Devlin | Getty Images News | Getty Images

This year, however, experts tend to agree that the polls show such a swing to Labour that, even if the scale of support were wrong, the overall result would be the same: a convincing win for the opposition party.

“My attitude is [that] a poll should be taken but not inhaled,” Curtice said wryly. “The point is, you shouldn’t be looking at them to provide you with pinpoint accuracy, they should give you a reasonable indication of the direction of travel.”

“It just so happens that because this is an election in which apparently one party is so far ahead, much as [it was] in 1997, the polls could be quite a bit out — but nobody will notice,” he noted, referencing the year when the Labour Party won a landslide against the Conservatives, ending the latter party’s then 18-year rule.

Labour ‘spin’?

The Labour Party itself is understandably keen to downplay the polls, with a spokesperson telling CNBC that the party doesn’t comment on projections, “as they vary and fluctuate.”

“Instead, we’re working hard to take our message of change to voters ahead of the only poll that matters, on 4 July,” the spokesperson stated.

On Monday, Keir Starmer said no vote should be taken for granted, asking his supporters to continue campaigning until polls closed on Thursday.

“The fight for change is for you, but change will only happen if you vote for it. That is the message we have to take to every doorstep these last few hours and days until 10 o’clock on Thursday night.”

“Nothing must be taken for granted, every vote has to be earned. The polls don’t predict the future, we have to get out there,” he told campaign supporters in Hitchin.

Labour leader Sir Keir Starmer during a visit to Hitchin, Hertfordshire, while on the General Election campaign trail. Picture date: Monday July 1, 2024.

Stefan Rousseau – Pa Images | Pa Images | Getty Images

Labour’s former campaign and communications directors, Alastair Campbell, one of the chief strategists behind the rebranding of the party in the 1990s as ‘New Labour’ ahead of its monumental election win in 1997, told CNBC that he doubts current voter polls.

“I get really worried about about the way that these election debates are now unfolding, virtually everything in the debate at the moment is about these opinion polls,” he told CNBC two weeks ago.

“Apart from a few postal votes, nobody’s voted yet. And I just do not for one second believe that the Conservatives are going to get virtually wiped out, I just don’t believe it,” he said.

“I just think there’s something going very, very wrong with these polls, I could be completely wrong, and it’s true that Labour have been consistently ahead. But I just wish that, in our election periods, we would talk less about polls and more about what the parties are saying.”

Polling expert Matt Beech, director of the Centre for British Politics at the University of Hull, said Campbell’s position was designed to persuade Labour-inclined voters to cast their ballots.

“They want to make sure that they get as big a majority as possible. They’re all very much aware of [the lead-up to the election in] 1992 with the phenomenon of ‘shy Tories,’ when the polls said Labour would win and they didn’t …. [But] they’re not actually that genuinely worried about that. What they want to have a 1997-like landslide tsunami,” Beech told CNBC.

He added, “So if you keep banging on that drum [that the polls are not correct], you’re going to say to Labour-inclined voters, ‘please go out and vote.’ But it’s not that ‘we’re actually scared we’re not going to win, we are going to win comfortably. But we want a majority that enables us to push our agenda and we want this win to mean that we’re there for two terms.’“

Business

Ad-supported Murdoch Netflix rival to launch in the UK

Rupert Murdoch’s Fox Corporation is entering the UK’s highly competitive free, ad-supported video streaming market.

Tubi will compete with the likes of Netflix, Disney+, ITVX, Channel 4’s streaming platform as well as the BBC iPlayer.

The platform has been quickly gaining market share in the US where, according to Fox, it has almost 80 million monthly active users.

In the UK, Tubi says it will offer more than 20,000 films and TV series, including content from Disney, Lionsgate, NBCUniversal and Sony Pictures Entertainment.

The platform will also include a selection of British, Indian and Nigerian content.

UK viewers will be able to access content on the Tubi webpage and via a smartphone app.

Fox Corporation bought Tubi in 2020 for $440m (£348m) as the US media giant looked to attract younger audiences.

In recent years, streaming companies like Netflix, Amazon Prime Video and Disney+ have launched ad-supported services and raised subscription prices as they tried to boost revenues.

The moves came as they faced pressure to spend more money to grow their libraries of content as they try to attract more customers in an increasingly competitive market.

In March, Mr Murdoch’s TalkTV network announced that it would stop broadcasting as a terrestrial television channel and became a strictly online service.

The network launched in 2022 but struggled to attract viewers on its linear platform.

Mr Murdoch had hoped the network would shake up the broadcasting establishment by offering an opinion-led alternative to established outlets.

The media tycoon played a pivotal role in the development of the UK’s broadcasting industry by launching Sky in 1984.

Some commentators saw TalkTV as an attempt by Mr Murdoch to recreate his success with Sky.

Mr Murdoch’s 21st Century Fox sold its 39% stake in Sky to NBCUniversal’s owner Comcast in 2018 after losing a battle for control of the network.

Business

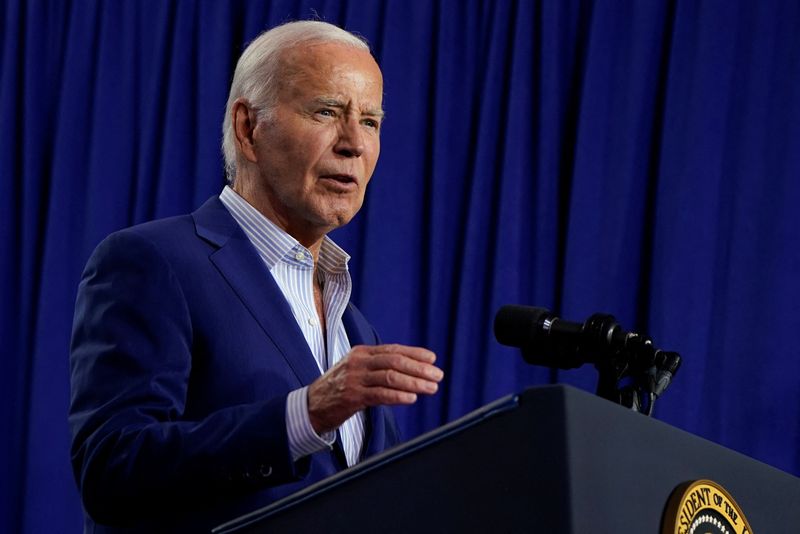

Biden knocks Supreme Court ruling on presidential immunity By Reuters

By Andrea Shalal

WASHINGTON (Reuters) -U.S. President Joe Biden on Monday criticized the Supreme Court ruling on presidential immunity that was seen as a win for his rival, former President Donald Trump, in forceful remarks from the White House.

The U.S. Supreme Court found on Monday that Trump cannot be prosecuted for any actions that were within his constitutional powers as president, but can be for private acts, in a landmark ruling recognizing for the first time any form of presidential immunity from prosecution.

“This nation was founded on the principle that there are no kings in America,” Biden said, adding that no one is above the law. With the Supreme Court decision, he said, “That fundamentally changed.”

Biden is running for re-election against Trump and has been sharply critical of his rival’s actions related to the Jan. 6, 2021, raid on the U.S. Capitol by Trump’s supporters, who believed Trump’s false claims that he had won the 2020 election.

Biden, 81, was making his first set of remarks at the White House since his shaky debate against Trump last week led to calls for him to step aside as the Democratic Party’s standard-bearer for the election.

After he stumbled over his words on the Atlanta debate stage, his remarks and comportment will be scrutinized for signs that he is up to the job of running for re-election and of governing the country for four more years.

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History5 months ago

African History5 months agoBlack History Facts I had to Learn on My Own pt.6 📜

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History1 year ago

African History1 year agoMajor African Tribes taken away during the Atlantic Slave Trade🌍 #slavetrade #africanamericanhistory

-

African History1 year ago

African History1 year agoCameroon 🇨🇲 World Cup History (1962-2022) #football #realmadrid #shorts

-

African History1 year ago

African History1 year agoPROOF AFRICAN AMERICANS AIN'T FROM AFRICA DOCUMENTED EVIDENCE

-

African History5 months ago

African History5 months agoBlack History Inventors: Mary Kenner 🩸

-

African History5 months ago

African History5 months agoMr Incredible Becoming Canny/Uncanny Mapping (You live in Paraguay 🇵🇾)