Sci-Tech

How Pet Care Became a Big Business

Heather Massey brought Ladybird to the veterinarian when the 9-year-old mutt began having seizures. A scan from an M.R.I. machine revealed bad news: brain cancer.

With the prognosis grim, Ms. Massey decided against further treatment at the animal hospital near her home in Athens, Ga., and Ladybird died four months later. The M.R.I. scan and related care had cost nearly $2,000, which Ms. Massey put on a specialty credit card she had learned about at a previous vet visit.

That was in 2018. She is still paying off the debt, with more than 30 percent interest.

“Could I afford to do that? Not really,” said Ms. Massey, 52, who is disabled and does not work. “Was it worth it to me? Yes.”

Ms. Massey’s experience illustrates the expensive new realities of owning a pet. For decades, veterinarians typically operated their own clinics, shepherding generations of pets from birth to death. They neutered, vaccinated and pulled thorns from paws and noses. When animals became seriously ill, vets often had little to offer beyond condolences and a humane death.

But in recent years, as people have grown more attached to their pets — and more willing to spend money on them — animal medicine has transformed into a big business that looks a lot like its human counterpart. Many veterinary offices have been replaced by hospitals outfitted with expensive M.R.I. machines, sophisticated lab equipment and round-the-clock intensive care units. Dogs and cats often see highly trained specialists in neurology, cardiology and oncology.

This high-tech care has spurred a booming market. Veterinary prices have soared more than 60 percent over the past decade, according to federal statistics. Private equity firms and large corporations have bought hundreds of facilities around the country, an acquisition spree reminiscent of the corporate roll-ups of doctors’ offices.

Veterinarians from around the country told The New York Times that their corporate managers were pushing clinics to become more efficient profit centers. Vets were often paid based on how much money they brought in, creating an incentive to see more pets, order more tests and upsell wellness plans and food.

The result is an increasingly unsustainable situation for animal owners, most of whom don’t have pet insurance.

The Times asked readers to share their stories about expensive vet bills, and hundreds responded. Sophia McElroy of Denver said she donated blood plasma and took extra freelance work to pay for her dog’s ongoing expenses.

Nancy Partridge of Waynesville, N.C., said that months after her cat was diagnosed with an inoperable tumor, she was still chipping away at the $1,500 bill. “We have a dead cat, and we’re still paying,” she said.

In 2015, Claire Kirsch was earning less than $10 an hour as a veterinary technician in Georgia when her own dog, Roscoe, and her horse, Gambit, each had medical emergencies, resulting in bills that totaled more than $13,000. Ms. Kirsch said her animals would have died had she not opted for additional care.

“I knew I would never be able to forgive myself if we didn’t try,” she said.

Ms. Kirsch maxed out a credit card, tapped into her husband’s retirement account and took out a personal loan. Roscoe lived another three years, and Gambit is still alive.

In interviews, veterinarians said pet owners who complained about care costs don’t appreciate the difficulties of running a clinic. Veterinarians make far less money than human doctors and are often in debt from years of education. Their prices have gone up partly because of the rising cost of drugs, vaccines and other supplies, as well as paying workers in a tight labor market.

And because of more advanced medical offerings, pets today can survive serious illnesses, like cancer, that would once have been unthinkable. They have access to surgeries and drugs that can vastly improve their lives.

“We live in the most technologically advanced time in human history, and how wonderful is that?” said Dr. Tracy Dewhirst, a veterinarian in Corryton, Tenn. “But it comes at a cost.”

Even run-of-the-mill visits can rack up big bills. Dr. David Roos, an 86-year-old veterinarian in Los Altos, Calif., said he decided to retire one day in 2014, when he checked on a dog whose owners were longtime clients. The animal had been admitted for vomiting. Dr. Roos said he normally would have told the owner to take the dog home and to give it sips of water. Instead, another vet had ordered X-rays, blood tests, intravenous fluids and a hospital stay. Dr. Roos knew the owners could not afford the bill.

“I realized at that stage that veterinary medicine had changed to the point where I no longer wanted to be a part of it,” Dr. Roos said.

With a growth in pet ownership and surveys showing that Americans are willing to go into debt to pay for their animals’ care, vet clinics have become increasingly attractive to investors. About one-quarter of primary care clinics and three-quarters of specialty clinics are now owned by corporations, according to Brakke Consulting, which focuses on the animal health industry.

In 2015, one major player, Mars — known for selling candy and pet food — acquired a specialty veterinary hospital chain, BluePearl, for an undisclosed sum. In 2017, it nabbed another hospital, VCA, for $9.1 billion. The trend peaked in 2021, with more than 200 private equity deals, according to Pitchbook.

Several veterinarians who have worked in corporate practices said that they were pressured to drive more business. One vet from California said she quit her job after she was told her “cost per client” was too low. Another, from Virginia, said she was told she needed to see 21 animals per day. A third, from Colorado, said she was taken aback when she overheard a manager saying some of the vets at her office needed coaching on “getting the client to a yes.” These vets asked to withhold their names because they worried that speaking out could jeopardize future job prospects with private-equity practices.

Other vets said that corporate ownership had no influence on the care they provided. Still, Dr. Andrew Federer, the medical director of a clinic in Mentor, Ohio, that is owned by a chain called National Veterinary Associates, said that when someone’s pay is tied to how many procedures and tests they perform, the incentives could be difficult to ignore, especially for vets who were just starting out.

“The more they bring into the hospital above their current salary, the more of a production bonus they will receive,” he said.

Only about 4 percent of pet owners have insurance, and even for them, the options are limited. Pet insurance often excludes pre-existing conditions and costs more for older pets who are more likely to get sick.

Companies can also change the terms. This spring, the insurance company Nationwide notified thousands of pet owners that it was discontinuing their coverage, leaving them scrambling to enroll in new plans that excluded the pets’ pre-existing conditions. About 100,000 plans are being discontinued, said Kevin Kemper, a Nationwide spokesman.

Stephanie Boerger of Royal Oak, Mich., said that Nationwide had been covering her cat’s chemotherapy, but told her it would not renew her plan when it expired in August. The treatment, which costs about $1,000 every other month, will not be covered under any available plan.

“Now I feel like I have to choose between paying for my cat’s chemo or letting her die,” said Ms. Boerger, who was able to find new coverage through a competing company.

In a statement, the Nationwide spokesman cited the rising cost of veterinary care. “We are making these tough decisions now so that we can continue to be here for even more pets in the future,” he said.

Many veterinarians offer specialty credit cards sold by outside companies, such as the CareCredit card that was used by Ms. Kirsch and Ms. Massey. Last year, the Biden administration warned that these medical credit cards — which were also promoted by doctors and dentists — drove many consumers into debilitating debt. A spokeswoman for CareCredit said that about 80 percent of cardholders paid off their debt before the no-interest introductory period expired.

Some groups, including the American Society for the Prevention of Cruelty to Animals, are researching how vets can perform common procedures more cheaply. And many veterinarians say they try to offer a “spectrum of care,” a nonjudgmental way of discussing less expensive options.

For many people, a pet’s companionship is priceless.

After Ladybird died, Ms. Massey adopted Lunabear, a Lab mix that she jokes is “allergic to the very air we breathe.” Lunabear needs prescription food that costs $6 a can and takes a $3 allergy pill three times a day. Last year, she had leg surgery.

These costs have totaled nearly $4,000, much of which has been charged to the high-interest credit card. But Ms. Massey, who has major depression and lives alone, said her dogs took top priority. “I pay my bills, and then I buy food,” she said.

Ben Casselman contributed reporting.

Sci-Tech

$10,000 cooler designed with AI keeps Core i9-14900KF chilly at 7.5 GHz

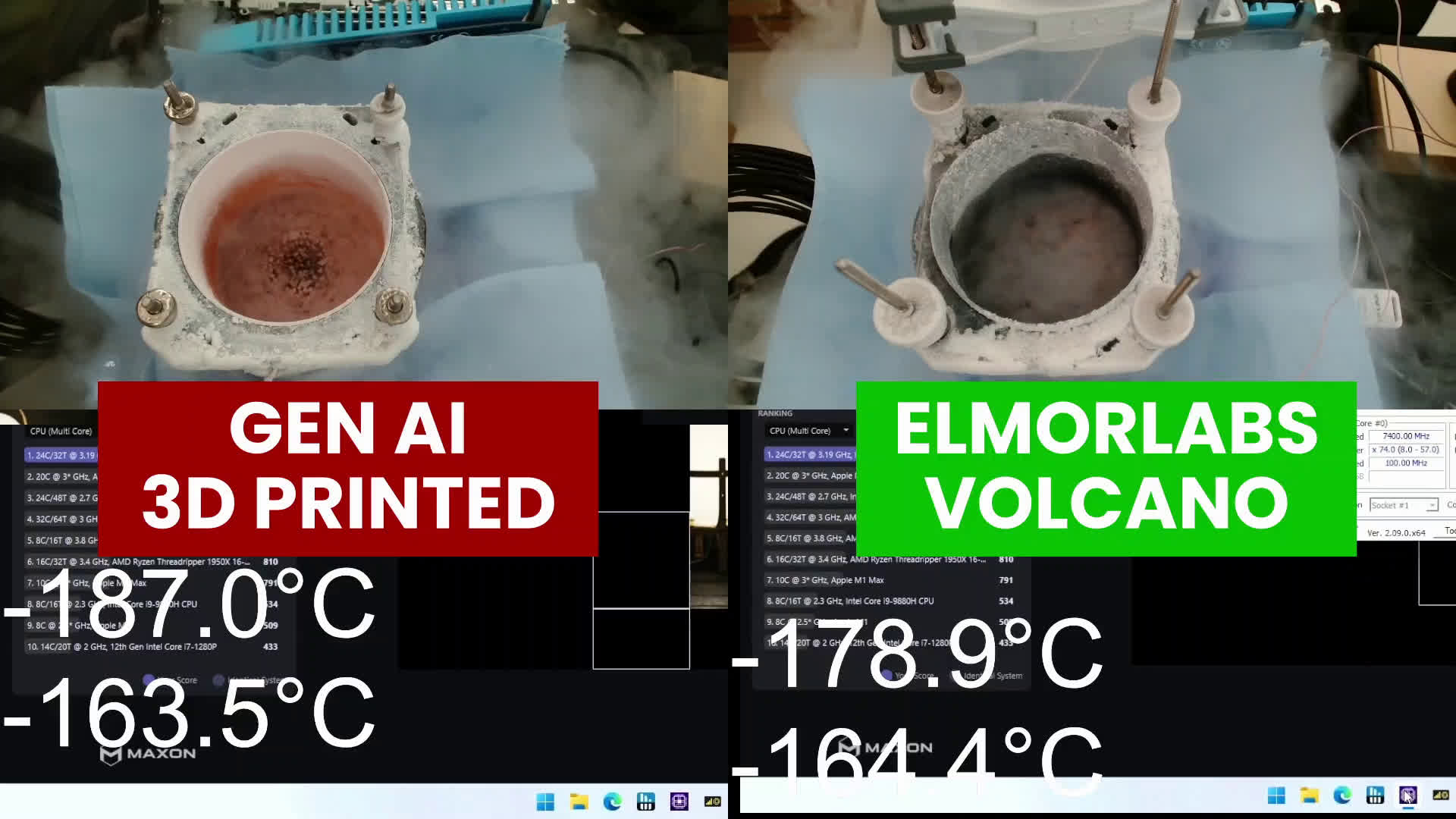

Pushing the limits: Enthusiasts are always looking for an edge in the world of overclocking and extreme cooling. In this wild test, the team sought to determine whether advanced GenAI and 3D printing could help them squeeze out more performance from today’s processors. To answer this, they built a liquid nitrogen (LN2) container in a whole new way – and arrived at some interesting conclusions.

The project brought together experts from across the ecosystem – Skatterbencher who’s renowned for overclocking prowess; Diabatix, specializing in generative AI for thermal solutions; 3D Systems for additive manufacturing; and finally ElmorLabs for overclocking gear.

The team took ElmorLabs’ existing Volcano LN2 container as a reference point, then tasked Diabatix’s ColdStream Next AI to generate an improved design. 3D Systems then brought that digital blueprint to life, 3D printing a prototype using oxygen-free copper powder. Shockingly though, the cutting-edge process commanded a steep $10,000 price tag – a far cry from the $260 cost of the original Volcano.

The AI/3D printed design showed promise in early testing, focusing on three key metrics: cool-down time from room temperature to -194°C, heat-up time from -194°C to 20°C under a 1250W load, and the lowest temperature achieved using 500mL of liquid nitrogen.

It blew past the Volcano in cool-down speed, chilling from 28°C to -194°C in under a minute compared to the Volcano’s 3-minute pace. Heat-up performance was better too, with the AI container warming up 30% faster. Efficiency also favored the AI design – using 500mL of LN2, it hit -133°C, while the Volcano stopped short at -100°C.

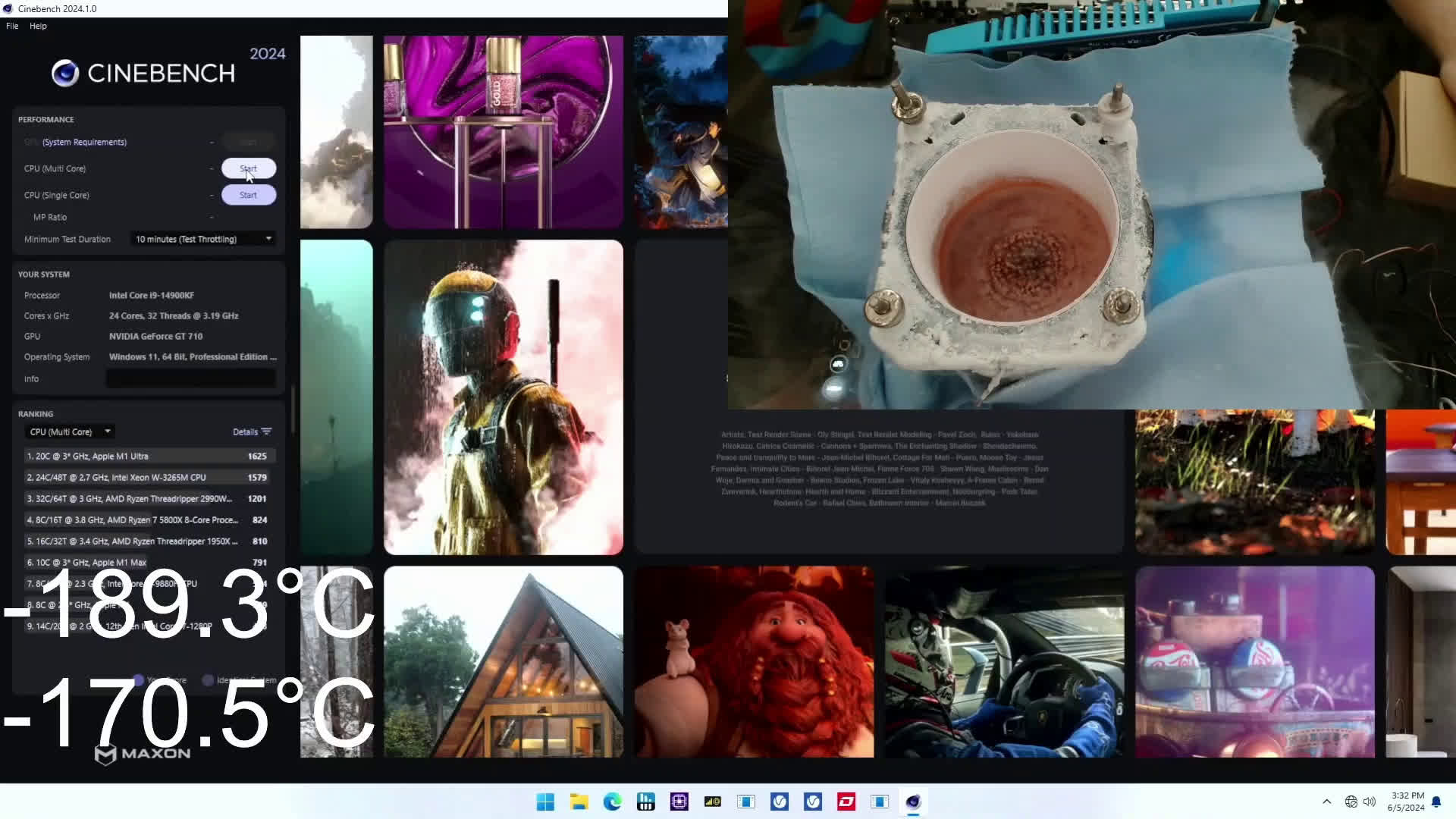

However, since these tests do not represent real-world performance, the team decided to run three more using the Intel Core i9-14900KF Raptor Lake processor. First, they fired up Cinebench 2024 to find the most stable maximum CPU frequency.

“We find that both LN2 containers can handle the Core i9-14900KF with P-cores clocked to 7.4 GHz without any issue. It seemed the AI-generated design could perhaps hold 7.5 GHz just a tad longer. But that might just be run-to-run variation,” they noted.

In the second test, they checked the CPU temperature deltas between the heat spreader and cooling container base to assess real heat transfer capabilities. There was also an all-out stress test, pushing over 600W through the chip for several minutes.

While the AI container did pull ahead a smidge, the gains were relatively muted compared to the theoretical test results. Temperature deltas between the CPU heat spreader and container base were tighter on the 3D-printed model, but not by an earth-shattering margin. Even the performance uplift in Cinebench was fairly modest, as seen above.

After crunching the numbers, the team determined that while technically impressive, the AI/3D printed design currently doesn’t pencil out from a cost/benefit perspective for modest overclocking scenarios. Not with that $10,000 price tag.

However, they are not done yet. While “nothing concrete” is in hand, the team says they could look into performance and cost optimizations. The design of the LN2 container doesn’t necessarily need to be circular, for example. They are also exploring new designs for higher-power CPUs like the Ryzen Threadripper or Intel’s Xeon 6.

All in all, the feasibility study may have exposed some limitations, but it also proved generative AI has better uses than simply churning out six-fingered models.

Sci-Tech

Microsoft resumes rollout of Windows 11 KB5039302 update for most users

Microsoft has resumed the rollout of the June Windows 11 KB5039302 update, now blocking the update only for those using virtualization software.

On Wednesday, Microsoft pulled the KB5039302 update after Windows 11 users found that their devices went into a reboot loop after it was installed.

After investigating the issue, Microsoft determined that the bug mostly affects devices that utilize virtual machine tools and nested virtualization features, such as CloudPC, DevBox, and Azure Virtual Desktop. Others stated it also affected VMware.

Yesterday, in an update to Windows Message Center, Microsoft once again resumed rolling out the KB5039302 update to those not running virtualization software.

“Availability of this update via Windows Update and Windows Update for Business was paused for a couple of days, but is being resumed today for most devices,” reads the message center update.

“This update offering is now paused only for devices affected by the issue. As a result, this update might not be offered to Hyper-V virtual machines running on hosts that utilize certain processor types.”

Those who wish to install the update can now run Windows Update and install it as usual.

However, this update comes with another bug that causes the Taskbar not to display properly if you are using Windows N edition or have the ‘Media Features’ feature turned off in Control Panel > Programs > Programs and Features > Turn Windows features on or off.

Therefore, if you have disabled the Media Features or are running Windows N, which does not contain media-related technologies, you may want to hold off installing the update.

Microsoft is working on fixing both issues and will provide them in an upcoming release.

Sci-Tech

Is T-Mobile still the uncarrier we knew and loved, or just another carrier?

Edgar Cervantes / Android Authority

In 2012, the wireless industry was in a less-than-ideal state. AT&T and Verizon dominated the market, despite a reputation for price gouging. Meanwhile, Sprint and T-Mobile lagged behind in third and fourth place, respectively. In an effort to change its trajectory, T-Mobile hired John Legere as CEO. Legere wasn’t your typical corporate suit. He wore jeans and T-shirts, and cursed like a sailor. He was also outspoken about the poor policies and practices of the larger wireless carriers, and actually made a ton of big changes to the company through the “Uncarrier” marketing initiative.

This campaign aimed to disrupt traditional industry practices, such as two-year contracts, hidden fees, and sudden price increases. These transformations occurred against the backdrop of a planned merger with Sprint, which was finalized in 2020 after extensive negotiations. Fast forward to today, and the new T-Mobile now largely resembles the very companies Legere once vocally opposed.

Is T-mobile still the uncarrier you knew and loved?

64 votes

T-Mobile is starting to look a little like Verizon 2.0

Edgar Cervantes / Android Authority

There were many things T-Mobile criticized its competitors for, but pricing and clarity were chief among Legere’s concerns. In much softer words than he actually used, Legere once essentially accused Verizon and AT&T of being crooks who were taking us for every last cent. That’s just a bit ironic when you consider T-Mobile’s moves over the last few years. While the pandemic naturally drove up pricing, which is more forgivable, T-Mobile’s treatment of legacy customers is not.

First, T-Mobile attempted to automatically shift its legacy customers to newer plans unless the customer specifically contacted them to opt out. When this didn’t work, it ultimately ended up raising legacy pricing anyway, increasing prices by $5 per month per line for voice plans, and $2 per month per line for connected devices. It was also a slap in the face for customers who thought T-Mobile’s earlier Price Lock policies protected them.

T-Mobile used to offer some of the best phone deals, but these days, many of its top free phone offers are typically aimed exclusively at Go5G Plus and Next subscribers. Similarly, T-Mobile Tuesdays used to feature truly great exclusive discounts and promotions for events and much more. This experience has largely devolved into a very limited coupon book app, and many fear this will only worsen with the new T-Life direction.

Those are far from the only changes T-Mobile has made recently that go against the spirit of its Uncarrier movement. In April we learned T-Mobile could be profiling customers and collecting personal data to better predict user behavior. While this is an opt-out feature, I am willing to bet Legere’s T-Mobile would have never even tried something like this.

T-Mobile’s recent price increases and unclear customer changes are exactly the sort of things Legere once criticized Verizon and AT&T for.

Continuing its long line of moves that certainly aren’t customer-first in nature, T-Mobile recently clarified that its pricing could continue to increase, even for Price Lock customers. It also clarified that despite still using the name, T-Mobile customers with a plan from January 17, 2024 are actually on Price Lock 2.0. This newer version will refund you if you cancel due to price increases, but there’s really no promise it won’t continue to jack up prices.

Still not convinced this isn’t the same T-Mobile we all once gushed about? A new bill credits policy might just be enough to put you over the edge. The new policy means you’ll no longer receive bill credits for a free device if you decide to pay off the installment plan early. In other words, if you buy off your plan early, you lose out on your free phone deal.

T-Mobile is likely doing this to prevent customers from paying off a device early and then turning around and selling it for a high price. Before, you could sell the device and remove the installment plan while still receiving any free credits T-Mobile owed you.

All of this shows a carrier that is clearly not concerned with price increases or moves that are seen as less friendly by its existing customer base. This is exactly what Verizon and AT&T have been accused of doing. What makes T-Mobile feel even more like Verizon is that it seems to have set its sights on being the biggest and most powerful carrier.

It’s important to remember the Uncarrier phase was marketing first and foremost

I’ve noticed numerous online comments portraying John Legere as a hero, while Mike Sievert is blamed for T-Mobile’s recent shifts. However, it’s essential to recognize that the Uncarrier movement was primarily a marketing strategy. Legere was hired to revitalize the company, which he effectively did by adopting a relatable image, aggressively cutting costs, and disrupting the industry. But he didn’t do it because he was your friend. These were calculated business decisions.

Legere did his job well, and I respect him for that. However, I also understand how business works. T-Mobile knew that the changes under Legere’s leadership were only a temporary phase. After being promoted to COO, Mike Sievert and John Legere likely developed their strategy extensively. Phase 1 was focused on winning new customers and improving the network to compete with the major carriers. Phase 2 involved tightening the screws to generate real profits and secure T-Mobile’s position as one of the Big Three.

Legere was hired for a job and did it very well. So was Sievert: to make a profit at any cost.

Whether we like it or not, Mike Sievert was also hired for a specific purpose: to take this revitalized company and ensure it remains profitable both now and in the future. He has become the villain by raising prices and ensuring profitability even at the cost of customer satisfaction. It’s a less appealing role, but that doesn’t mean he isn’t doing his job. It’s a delicate balance — maintaining profitability while mitigating potential subscriber losses. T-Mobile likely anticipated some would leave once it was clear that the old Uncarrier days were over, but they planned ahead as best they could by acquiring the most prominent T-Mobile-based carriers.

Our own polls suggest that many of our tech-savvy readers are seriously considering switching to another carrier or even a prepaid service. Those who leave will likely seek coverage at least as good as what they had. If they were satisfied with the Uncarrier’s coverage, switching to Mint or another T-Mobile MVNO is an easy move. For every customer that switches away, a significant portion will still indirectly contribute to T-Mobile’s revenue. T-Mobile also anticipates that major customer losses are less likely among the elderly, large families, or those who are less tech-savvy and hesitant to switch.

Is T-Mobile actually any worse than the other members of the big three?

Edgar Cervantes / Android Authority

The big question is whether T-Mobile is any worse than the other members of the big three, and to answer that, I’d say no. The new T-Mobile actually holds a few strong advantages over the competition. While AT&T and Verizon spread device payments over three whole years, T-Mobile still defaults to 24 months. T-Mobile also offers slightly more competitive pricing, especially for larger families. It also has an increasingly strong and reliable network — customer service and pricing aside. The main takeaway is that it’s no longer the “uncarrier” we once knew; it’s now more just “another member of the big three,” for better or worse.

For many, T-Mobile might still be the best of the big three. However, for most, I’d suggest moving to one of the many excellent prepaid services, which have evolved considerably over the years. Some prepaid carriers, like Google Fi Wireless, offer the same high-quality data, device payment plans, and other features typically associated with postpaid services.

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History5 months ago

African History5 months agoBlack History Facts I had to Learn on My Own pt.6 📜

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History1 year ago

African History1 year agoMajor African Tribes taken away during the Atlantic Slave Trade🌍 #slavetrade #africanamericanhistory

-

African History1 year ago

African History1 year agoPROOF AFRICAN AMERICANS AIN'T FROM AFRICA DOCUMENTED EVIDENCE

-

African History1 year ago

African History1 year agoCameroon 🇨🇲 World Cup History (1962-2022) #football #realmadrid #shorts

-

African History5 months ago

African History5 months agoBlack History Inventors: Mary Kenner 🩸

-

African History4 months ago

African History4 months agoMr Incredible Becoming Canny/Uncanny Mapping (You live in Paraguay 🇵🇾)