Sci-Tech

The best Mint alternatives

As a former Mint user, I had to find a new budgeting app not too long ago. Intuit, parent company of Mint, shut down the service in March 2024, and prompted users to transition to its other financial app, Credit Karma. However, after testing Credit Karma myself, I found it to be a poor Mint replacement — that meant I needed to branch out and look elsewhere for a trusted app to track all of my financial accounts, monitor my credit score, follow a monthly spending plan and set goals like building a rainy-day fund and paying down my mortgage faster. I tried out Mint’s top competitors in the hopes that I’d be able to find a new budgeting app that could handle all of my financial needs. Hopefully my journey can help you find the best budgeting app for you and your money as well.

How we tested

Before I dove in and started testing out budgeting apps, I had to do some research. To find a list of apps to try out, I consulted trusty ol’ Google (and even trustier Reddit); read reviews of popular apps on the App Store; and also asked friends and colleagues what budget tracking apps they might be using for money management. Some of the apps I found were free and these, of course, show loads of ads (excuse me, “offers”) to stay in business. But most of the available apps require paid subscriptions, with prices typically topping out around $100 a year, or $15 a month. (Spoiler: My top pick is cheaper than that.)

All of the services I chose to test needed to do several things: import all of your account data into one place; offer budgeting tools; and track your spending, net worth and credit score. Except where noted, all of these apps are available for iOS, Android and on the web.

Once I had my shortlist of six apps, I got to work setting them up. For the sake of thoroughly testing these apps, I made a point of adding every account to every budgeting app, no matter how small or immaterial the balance. What ensued was a veritable Groundhog Day of two-factor authentication. Just hours of entering passwords and one-time passcodes, for the same banks half a dozen times over. Hopefully, you only have to do this once.

Best budgeting apps of 2024

No pun intended, but what I like about Quicken Simplifi is its simplicity. Whereas other budgeting apps try to distinguish themselves with dark themes and customizable emoji, Simplifi has a clean user interface, with a landing page that you just keep scrolling through to get a detailed overview of all your stats. These include your top-line balances; net worth; recent spending; upcoming recurring payments; a snapshot of your spending plan; top spending categories; achievements; and any watchlists you’ve set up. You can also set up savings goals elsewhere in the app. I also appreciate how it offers neat, almost playful visualizations without ever looking cluttered. I felt at home in the mobile and web dashboards after a day or so, which is faster than I adapted to some competing services (I’m looking at you, YNAB and Monarch).

Getting set up with Simplifi was mostly painless. I was particularly impressed at how easily it connected to Fidelity; not all budget trackers do, for whatever reason. This is also one of the only services I tested that gives you the option of inviting a spouse or financial advisor to co-manage your account. One thing I would add to my initial assessment of the app, having used it for a few months now: I wish Simplifi offered Zillow integration for easily tracking your home value (or at least a rough estimate of it). Various competitors including Monarch Money and Copilot Money work with Zillow, so clearly there’s a Zillow API available for use. As it stands, Simplifi users must add real estate manually like any other asset.

In practice, Simplifi miscategorized some of my expenses, but nothing out of the ordinary compared to any of these budget trackers. As you’re reviewing transactions, you can also mark if you’re expecting a refund, which is a unique feature among the services I tested. Simplifi also estimated my regular income better than some other apps I tested. Most of all, I appreciated the option of being able to categorize some, but not all, purchases from a merchant as recurring. For instance, I can add my two Amazon subscribe-and-saves as recurring payments, without having to create a broad-strokes rule for every Amazon purchase.

The budgeting feature is also self-explanatory. Just check that your regular income is accurate and be sure to set up recurring payments, making note of which are bills and which are subscriptions. This is important because Simplifi shows you your total take-home income as well as an “income after bills” figure. That number includes, well, bills but not discretionary subscriptions. From there, you can add spending targets by category in the “planned spending” bucket. Planned spending can also include one-time expenditures, not just monthly budgets. When you create a budget, Simplifi will suggest a number based on a six-month average.

Not dealbreakers, but two things to keep in mind as you get started: Simplifi is notable in that you can’t set up an account through Apple or Google. There is also no option for a free trial, though Quicken promises a “30-day money back guarantee.”

- Easy-to-use app with a gentle learning curve

- Does a good job detecting recurring income and bills

- Less expensive than the competition

- Lets you share app access with a spouse or financial advisor

- Handy refund tracker

- No free trial

- You can’t create an account using your Apple or Google ID

- No Zillow integration

Monarch Money grew on me. My first impression of the budgeting app, which was founded by a former Mint product manager, was that it’s more difficult to use than others on this list, including Simplifi, NerdWallet and Copilot. And it is. Editing expense categories, adding recurring transactions and creating rules, for example, is a little more complicated than it needs to be, especially in the mobile app. (My advice: Use the web app for fine-tuning details.) Monarch also didn’t get my income right; I had to edit it.

Once you’re set up, though, Monarch offers an impressive level of granularity. In the budgets section, you can see a bona fide balance sheet showing budgets and actuals for each category. You’ll also find a forecast, for the year or by month. And recurring expenses can be set not just by merchant, but other parameters as well. For instance, while most Amazon purchases might be marked as “shopping,” those for the amounts of $54.18 or $34.18 are definitely baby supplies, and can be automatically marked as such each time, not to mention programmed as recurring payments. Weirdly, though, there’s no way to mark certain recurring payments as bills, specifically.

Not long after I first published this story in December 2023, Monarch introduced a detailed reporting section where you can create on-demand graphs based on things like accounts, categories and tags. That feature is available just on the web version of the app for now. As part of this same update, Monarch added support for an aggregator that makes it possible to automatically update the value of your car. This, combined with the existing Zillow integration for tracking your home value, makes it easy to quickly add a non-liquid asset like a vehicle or real estate, and have it show up in your net worth graph.

The mobile app is mostly self-explanatory. The main dashboard shows your net worth; your four most recent transactions; a month-over-month spending comparison; income month-to-date; upcoming bills; an investments snapshot; a list of any goals you’ve set; and, finally, a link to your month-in-review. That month-in-review is more detailed than most, delving into cash flow; top income and expense categories; cash flow trends; changes to your net worth, assets and liabilities; plus asset and liability breakdowns. In February 2024, Monarch expanded on the net worth graph, so that if you click on the Accounts tab you can see how your net worth changed over different periods of time, including one month, three months, six months, a year or all time.

On the main screen, you’ll also find tabs for accounts, transactions, cash flow, budget and recurring. Like many of the other apps featured here, Monarch can auto-detect recurring expenses and income, even if it gets the category wrong. (They all do to an extent.) Expense categories are marked by emoji, which you can customize if you’re so inclined.

Monarch Money uses a combination of networks to connect with banks, including Plaid, MX and Finicity, a competing network owned by Mastercard. (I have a quick explainer on Plaid, the industry standard in this space, toward the end of this guide.) As part of an update in late December, Monarch has also made it easier to connect through those other two networks, if for some reason Plaid fails. Similar to NerdWallet, I found myself completing two-factor authentication every time I wanted to get past the Plaid screen to add another account. Notably, Monarch is the only other app I tested that allows you to grant access to someone else in your family — likely a spouse or financial advisor.

Additionally, Monarch just added the ability to track Apple Card, Apple Cash, and Savings accounts, thanks to new functionality brought with the iOS 17.4 update. It’s not the only one either; currently, Copilot and YNAB have also added similar functionality that will be available to anyone with the latest versions of their respective apps on a device running iOS 17.4. Instead of manually uploading statements, the new functionality allows apps like Monarch’s to automatically pull in transactions and balance history. That should make it easier to account for spending on Apple cards and accounts throughout the month.

Monarch also recently launched investment transactions in beta. It also says bill tracking and an overhauled goals system are coming soon. Monarch hasn’t provided a timeline for that last one, except to say that the improved goals feature is coming in early 2024.

- Lots of detail and opportunities for customization

- Helpful “goals” feature

- You can grant account access to other people

- Chrome extension for importing from Mint

- Month-in-review recap is more thorough than most

- Car value syncing

- Zillow integration

- Steeper learning curve than some other budget trackers

- The mobile app feels restricted and less intuitive than the web version

- Doesn’t seem to distinguish between bills and other recurring expenses

- Some bugginess on mobile around creating rules for expense categories

You may know NerdWallet as a site that offers a mix of personal finance news, explainers and guides. I see it often when I google a financial term I don’t know and sure enough, it’s one of the sites I’m most likely to click on. As it happens, NerdWallet also has the distinction of offering one of the only free budgeting apps I tested. In fact, there is no paid version; nothing is locked behind a paywall. The main catch: There are ads everywhere.

Even with the inescapable credit card offers, NerdWallet has a clean, easy-to-understand user interface, which includes both a web and a mobile app. The key metrics that it highlights most prominently are your cash flow, net worth and credit score. I particularly enjoyed the weekly insights, which delve into things like where you spent the most money or how much you paid in fees — and how that compares to the previous month. Because this is NerdWallet, an encyclopedia of financial info, you get some particularly specific category options when setting up your accounts (think: a Roth or non-Roth IRA).

As a budgeting app, NerdWallet is more than serviceable, if a bit basic. Like other apps I tested, you can set up recurring bills. Importantly, it follows the popular 50/30/20 budgeting rule, which has you putting 50% of your budget toward things you need, 30% toward things you want, and the remaining 20% into savings or debt repayments. If this works for you, great — just know that you can’t customize your budget to the same degree as some competing apps. You can’t currently create custom spending categories, though a note inside the dashboard section of the app says “you’ll be able to customize them in the future.” You also can’t move items from the wants column to “needs” or vice versa but “In the future, you’ll be able to move specific transactions to actively manage what falls into each group.” A NerdWallet spokesperson declined to provide an ETA, though.

Lastly, it’s worth noting that NerdWallet had one of the most onerous setup processes of any app I tested. I don’t think this is a dealbreaker, as you’ll only have to do it once and, hopefully, you aren’t setting up six or seven apps in tandem as I was. What made NerdWallet’s onboarding especially tedious is that every time I wanted to add an account, I had to go through a two-factor authentication process to even get past the Plaid splash screen, and that’s not including the 2FA I had set up at each of my banks. This is a security policy on NerdWallet’s end, not Plaid’s, a Plaid spokesperson says.

Precisely because NerdWallet is one of the only budget trackers to offer credit score monitoring, it also needs more of your personal info during setup, including your birthday, address, phone number and the last four digits of your social security number. It’s the same with Credit Karma, which also does credit score monitoring.

Related to the setup process, I found that NerdWallet was less adept than other apps at automatically detecting my regular income. In my case, it counted a large one-time wire transfer as income, at which point my only other option was to enter my income manually (which is slightly annoying because I would have needed my pay stub handy to double-check my take-home pay).

- Free

- Easy to use

- Helpful weekly insights

- NerdWallet has a deep well of helpful financial explainers and guides

- One of the few options that offers credit score monitoring

- Ads everywhere

- No customization for spending categories

- Less adept at detecting regular income

- One of the more tedious setup processes

Copilot Money might be the best-looking budgeting app I tested. It also has the distinction of being exclusive to iOS and Macs — at least for now. Andres Ugarte, the company’s CEO, has publicly promised that Android and web apps are coming in 2024 (more likely the second half of the year, Ugarte tells me). But until it follows through, I can’t recommend Copilot for most people with so many good competitors out there.

There are other features that Copilot is missing, which I’ll get into. But it is promising, and one to keep an eye on. It’s just a fast, efficient, well designed app, and Android users will be in for a treat when they’ll finally be able to download it. It makes good use of colors, emoji and graphs to help you understand at a glance how you’re doing on everything from your budgets to your investment performance to your credit card debt over time. In particular, Copilot does a better job than almost any other app of visualizing your recurring monthly expenses.

Behind those punchy colors and cutesy emoji, though, is some sophisticated performance. Copilot’s AI-powered “Intelligence” gets smarter as you go at categorizing your expenses. (You can also add your own categories, complete with your choice of emoji.) It’s not perfect. Copilot miscategorized some purchases (they all do), but it makes it easier to edit than most. On top of that, the internal search feature is very fast; it starts whittling down results in your transaction history as soon as you begin typing.

Copilot is also unique in offering Amazon and Venmo integrations, allowing you to see transaction details. With Amazon, this requires just signing into your Amazon account via an in-app browser. For Venmo, you have to set up fwd@copilot.money as a forwarding address and then create a filter, wherein emails from venmo@venmo.com are automatically forwarded to fwd@copilot.money. Like Monarch Money, you can also add any property you own and track its value through Zillow, which is integrated with the app.

While the app is heavily automated, I still appreciate that Copilot marks new transactions for review. It’s a good way to both weed out fraudulent charges, and also be somewhat intentional about your spending habits.

Like Monarch Money, Copilot updated its app to make it easier to connect to banks through networks other than Plaid. As part of the same update, Copilot said it has improved its connections to both American Express and Fidelity which, again, can be a bugbear for some budget tracking apps. In an even more recent update, Copilot added a Mint import option, which other budgeting apps have begun to offer as well.

Because the app is relatively new (it launched in early 2020), the company is still catching up to the competition on some table-stakes features. Ugarte told me that his team is almost done building out a detailed cash flow section, which could launch before the end of 2023, but more likely in early 2024. On its website, Copilot also promises a raft of AI-powered features that build on its current “Intelligence” platform, the one that powers its smart expense categorization. These include “smart financial goals,” natural language search, a chat interface, forecasting and benchmarking. That benchmarking, Ugarte tells me, is meant to give people a sense of how they’re doing compared to other Copilot users, on both spending and investment performance. Most of these features should arrive in the new year.

Copilot does a couple interesting things for new customers that distinguish it from the competition. There’s a “demo mode” that feels like a game simulator; no need to add your own accounts. The company is also offering two free months with RIPMINT — a more generous introductory offer than most. When it finally does come time to pony up, the $7.92 monthly plan is cheaper than some competing apps, although the $95-a-year-option is in the same ballpark.

- Slick UI

- Standalone Mac app

- Lower monthly price than some competing apps

- Does a good job visualizing recurring expenses

- Optional Amazon, Venmo and Zillow integration

- “To review” section is handy

- No web or Android app yet

- Miscategorized more expenses than our top pick

- Lots of otherwise common features are still in development

YNAB is, by its own admission, “different from anything you’ve tried before.” The app, whose name is short for You Need a Budget, promotes a so-called zero-based budgeting system, which forces you to assign a purpose for every dollar you earn. A frequently used analogy is to put each dollar in an envelope; you can always move money from one envelope to another in a pinch. These envelopes can include rent and utilities, along with unforeseen expenses like holiday gifts and the inevitable car repair. The idea is that if you budget a certain amount for the unknowns each month, they won’t feel like they’re sneaking up on you.

Importantly, YNAB is only concerned with the money you have in your accounts now. The app does not ask you to provide your take-home income or set up recurring income payments (although there is a way to do this). The money you will make later in the month through your salaried job is not relevant, because YNAB does not engage in forecasting.

The app is harder to learn than any other here, and it requires more ongoing effort from the user. And YNAB knows that. Inside both the mobile and web apps are links to videos and other tutorials. Although I never quite got comfortable with the user interface, I did come to appreciate YNAB’s insistence on intentionality. Forcing users to draft a new budget each month and to review each transaction is not necessarily a bad thing. As YNAB says on its website, “Sure, you’ve got pie charts showing that you spent an obscene amount of money in restaurants — but you’ve still spent an obscene amount of money in restaurants.” I can see this approach being useful for people who don’t tend to have a lot of cash in reserve at a given time, or who have spending habits they want to correct (to riff off of YNAB’s own example, ordering Seamless four times a week).

My colleague Valentina Palladino, knowing I was working on this guide, penned a respectful rebuttal, explaining why she’s been using YNAB for years. Perhaps, like her, you have major savings goals you want to achieve, whether it’s paying for a wedding or buying a house. I suggest you give her column a read. For me, though, YNAB’s approach feels like overkill.

- Particularly strong emphasis on budgeting

- Unique “zero-dollar” approach to financial planning that some people swear by

- Steep learning curve

- Harder to use certain features on the mobile app than on the web

PocketGuard is one of the only reputable free budget trackers I found in my research. Just know it’s far more restricted at the free tier than NerdWallet. In my testing, I was prompted to pay after I attempted to link more than two bank accounts. So much for free, unless you keep things simple with one cash account and one credit card. When it comes time to upgrade to PocketGuard Plus, you have three options: pay $7.99 a month, $34.99 a year or $79.99 for a one-time lifetime license. That lifetime option is actually one of the few unique selling points for me: I’m sure some people will appreciate paying once and never having to, uh, budget for it again.

From the main screen, you’ll see tabs for accounts, insights, transactions and the “Plan,” which is where you see recurring payments stacked on top of what looks like a budget. The main overview screen shows you your net worth, total assets and debts; net income and total spending for the month; upcoming bills; a handy reminder of when your next paycheck lands; any debt payoff plan you have; and any goals.

Like some other apps, including Quicken Simplifi, PocketGuard promotes an “after bills” approach, where you enter all of your recurring bills, and then PocketGuard shows you what’s left, and that’s what you’re supposed to be budgeting: your disposable income. Obviously, other apps have a different philosophy: take into account all of your post-tax income and use it to pay the bills, purchase things you want and maybe even save a little. But in PocketGuard, it’s the “in your pocket” number that’s most prominent. To PocketGuard’s credit, it does a good job visualizing which bills are upcoming and which ones you’ve already paid.

PocketGuard has also publicly committed to adding some popular features in early 2024. These include rollover budgeting in January 2024, categorization rules in February and shared household access in March.

Although PocketGuard’s UI is easy enough to understand, it lacks polish. The “accounts” tab is a little busy, and doesn’t show totals for categories like cash or investments. Seemingly small details like weirdly phrased or punctuated copy occasionally make the app feel janky. More than once, it prompted me to update the app when no updates were available. The web version, meanwhile, feels like the mobile app blown up to a larger format and doesn’t take advantage of the extra screen real estate.

Of note, although PocketGuard does work with Plaid, its primary bank-connecting platform is actually Finicity. Setting up my accounts through Finicity was mostly a straightforward process. I did encounter one hiccup: Finicity would not connect to my SoFi account. I was able to do it through Plaid, but PocketGuard doesn’t make it easy to access Plaid in the app. The only way, as far as I can tell, is to knowingly search for the name of a bank that isn’t available through Finicity, at which point you get the option to try Plaid instead. Like I said: the experience can be janky.

- One of the only budget trackers with a free plan

- You can avoid an ongoing subscription fee by opting for a one-time lifetime license

- Less expensive than most competitors

- Helpful “upcoming bills” view in the app

- The free version is so restricted that the “free” label feels misleading; the user experience feels less polished than some competing apps

- The web app doesn’t take advantage of the larger screen space on desktop

FAQs

What is Plaid and how does it work?

Each of the apps I tested uses the same underlying network, called Plaid, to pull in financial data, so it’s worth explaining what it is and how it works. Plaid was founded as a fintech startup in 2013 and is today the industry standard in connecting banks with third-party apps. Plaid works with over 12,000 financial institutions across the US, Canada and Europe. Additionally, more than 8,000 third-party apps and services rely on Plaid, the company claims.

To be clear, you don’t need a dedicated Plaid app to use it; the technology is baked into a wide array of apps, including all of the budgeting apps listed in this guide. Once you find the “add an account” option in whichever one you’re using, you’ll see a menu of commonly used banks. There’s also a search field you can use to look yours up directly. Once you find yours, you’ll be prompted to enter your login credentials. If you have two-factor authentication set up, you’ll need to enter a one-time passcode as well.

As the middleman, Plaid is a passthrough for information that may include your account balances, transaction history, account type and routing or account number. Plaid uses encryption, and says it has a policy of not selling or renting customer data to other companies. However, I would not be doing my job if I didn’t note that in 2022 Plaid was forced to pay $58 million to consumers in a class action suit for collecting “more financial data than was needed.” As part of the settlement, Plaid was compelled to change some of its business practices.

In a statement provided to Engadget, a Plaid spokesperson said the company continues to deny the allegations underpinning the lawsuit and that “the crux of the non-financial terms in the settlement are focused on us accelerating workstreams already underway related to giving people more transparency into Plaid’s role in connecting their accounts, and ensuring that our workstreams around data minimization remain on track.”

Why did Mint shut down?

When parent company Intuit announced in December 2023 that it would shut down Mint, it did not provide a reason why it made the decision to do so. It did say that Mint’s millions of users would be funneled over to its other finance app, Credit Karma. “Credit Karma is thrilled to invite all Minters to continue their financial journey on Credit Karma, where they will have access to Credit Karma’s suite of features, products, tools and services, including some of Mint’s most popular features,” Mint wrote on its product blog. In our testing, we found that Credit Karma isn’t an exact replacement for Mint — so if you’re still looking for a Mint alternative, you have some decent options.

What about Rocket Money?

Rocket Money is another free financial app that tracks spending and supports things like balance alerts and account linking. If you pay for the premium tier, the service can also help you cancel unwanted subscriptions. We did not test it for this guide, but we’ll consider it in future updates.

Sci-Tech

Apple banks on AI to boost sales of its new iPhone

Getty Images

Getty ImagesWith business slumping, Apple has been under pressure to show what it will offer buyers to jumpstart a new wave of iPhone sales.

On Monday, the technology giant revealed its hand – the iPhone 16 which has a camera button on the outside of the handset.

The button is an external clue to the changes Apple said it had made inside its latest smartphone, aimed at harnessing the latest in artificial intelligence (AI).

Apple’s chief executive Tim Cook said the upgrades would “push the boundaries of what a smartphone can do” but the firm has tough competition, as other brands have already integrated generative AI features into their handsets.

Apple’s share price fell during its “Glowtime” event, where it unveiled the iPhone 16 as well as other products, and ended the day flat. The company, worth $3 trillion, is facing concern that it is losing its edge in the burgeoning area of artificial intelligence.

Sales of the iPhone – Apple’s most important product which accounts for around half of its total sales – have stalled in recent months. They slipped by 1% over the nine months ended 29 June compared with a year earlier.

Apple said its new phones, which come with longer lasting batteries, more powerful chips and enhanced privacy features, were its first built specifically to handle AI and its new “Apple Intelligence” tools, many of which were announced in June.

Those include new tools for writing and creating new emojis as well incorporating OpenAI’s chatbot ChatGPT into Siri to help users with some queries and text generation requests.

On Monday, Apple also announced updates to its Apple Watch and its AirPod headphones, which will allow them to automatically drop the volume when users start in-person conversations and to decline calls with the shake of a head.

It said the Pro version of its AirPods would be able to be used as a “clinical grade” personal hearing aid for people with mild or moderate hearing loss.

The company said it was expecting marketing approval from regulators for the device “soon” and the feature would be available this autumn in more than 100 countries, including the US, Germany and Japan.

Previously, the company had a feature that allowed people to pair hearing aids with iPhones and other devices.

The products were rolled out at a glossy event where protestors gathered in a designated free speech area across the street, urging executives to ramp up efforts to protect children from dangerous content in the company’s App Store.

The protest featured a life-sized blow-up made to resemble Mr Cook.

Sales of the new range start in September, with prices for the iPhone16 starting at $799.

But the Apple Intelligence features are not set to be available on operating systems until October, starting in the US and heading to other countries in the following months. They will be available in the UK in December.

Ben Wood, chief analyst at the market research firm CCS Insight, said it was likely that many people would dismiss the company’s new camera control as a “glorified shutter button”.

But he said it offered “very significant” upgrades, including visual, AI-powered search and he came away from the presentation persuaded that Apple would win over customers.

“The combination of Apple Intelligence and new camera features on the iPhone 16 will help spur upgrades from loyal Apple customers,” he said. “Particularly as Apple is positioning this latest update as being a future-proof purchase for customers wanting to get Apple Intelligence features as they roll out over the next few years.”

EPA

EPAApple has been slower than rivals Samsung and Google to bake generative AI features for photo editing, translation and web browsing into its devices.

Competitors are now building them into folding, flipping and even tri-folding smartphones.

Pre-orders for Huawei’s new tri-fold phone, the Mate XT, reportedly hit more than three million on Monday.

Gartner analyst Annette Zimmermann said because Apple was rolling out AI-ready smartphones later than rivals, it was “critical” they deliver.

She warned that rolling the features out before they were ready could risk their reputation or prompt sales losses.

Sci-Tech

Google’s lucrative ad tech business goes on trial

The US government is taking aim at the engine of Google’s immense wealth – its extremely lucrative ad tech business.

A trial beginning on Monday will hear the Department of Justice’s case that the search engine’s parent company Alphabet illegally operates a monopoly in the market.

The company earned more than $200 billion (£152bn) last year through the placing and selling of ads seen by internet users.

Alphabet has argued its success is due to the “effectiveness” of its services – but prosecutors say it has used its market dominance to stifle rivals.

“It is a really important industry that grabs billions of consumer dollars every year,” said Laura Phillips-Sawyer, a professor at the University of Georgia School of Law.

“I think all consumers have an interest in this litigation.”

It is the second major antitrust case the tech giant has faced in the US.

In August a judge ruled its dominance of search was illegal, with the penalties Google and Alphabet will face as a result of that decision so far unclear.

According to the lawsuit filed by the Department of Justice (DoJ) and a coalition of states in 2023, Google dominates the digital ad marketplace and has leveraged its market power to stifle innovation and competition.

Google meanwhile contends it is just one of several hundred companies that facilitate the placement of digital ads in front of consumers.

It argues that competition in the digital ad space is growing, not contracting – citing increased ad growth and revenues for companies such as Apple, Amazon and TikTok as proof in a blog post responding to the DoJ’s lawsuit in 2023.

Both sides will present their cases to US District Judge Leonie Brinkema, who is expected to deliver a verdict.

The bench trial comes on the heels of a landmark decision last month in a different monopoly case brought by the Justice Department against Google.

Judge Amit Mehta ruled that Google acted illegally to squelch competition in its online search business.

“Google is a monopolist, and it has acted as one to maintain its monopoly,” he wrote.

During last year’s trial, Google said it dominated online search because it had a better product.

And the company is seemingly deploying a similar defence in the ad tech case.

When asked for a statement, it referred the BBC to its 2023 blog post, in which it states that “no-one is forced to use our advertising technologies – they choose to use them because they’re effective.”

Judge Mehta held a status conference on Friday as he begins the process of deciding on remedies for Google’s conduct.

“The DoJ clearly had a big win, and they’re going to ride that momentum,” Dan Ives, managing director at Wedbush Securities, told the BBC.

He said he expects those remedies to involve “business model tweaks, not a breakup” of the company.

Meanwhile, in Justice Brinkema’s courtroom, the arcane process that governs advertising technology could make the DoJ’s attempts to prove its case an uphill climb.

“We all use search. We all intuitively understand that product,” said Rebecca Haw Allensworth, an antitrust professor at Vanderbilt University Law School.

By comparison, advertising technology is “so complex that I think that’s going to be a real challenge for the government to make a clear, simple monopolisation argument here.”

The US is not the only country where regulators are unhappy with Google’s ad tech business.

On Friday, the UK Competition and Markets Authority said it believed Google was abusing its dominance in the ad tech industry, according to the findings of its initial investigation.

It said it found that Google used anti-competitive practices to dominate the market for online advertising technology – and the potentially unlawful behaviour could be harming thousands of UK publishers and advertisers.

A Google representative said the decision was based on a “flawed” understanding of the ad tech sector.

Sci-Tech

Thieves snatched his phone in London

Akara Etteh

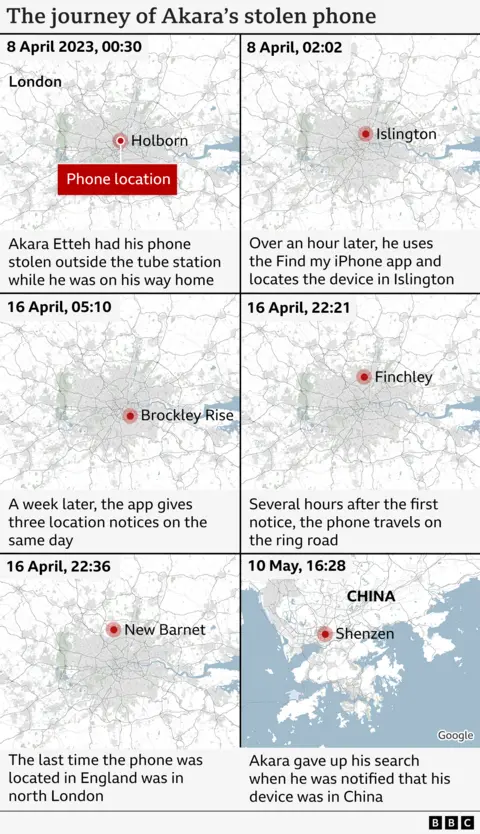

Akara EttehEarly on a Saturday morning in April, Akara Etteh was checking his phone as he came out of Holborn tube station, in central London.

A moment later, it was in the hand of a thief on the back of an electric bike – Akara gave chase, but they got away.

He is just one victim of an estimated 78,000 “snatch thefts” in England and Wales in the year to March, a big increase on the previous 12 months.

The prosecution rate for this offence is very low – the police say they are targeting the criminals responsible but cannot “arrest their way out of the problem”. They also say manufacturers and tech firms have a bigger role to play.

Victims of the crime have been telling the BBC of the impact it has had on them – ranging from losing irreplaceable photos to having tens of thousands of pounds stolen.

And for Akara, like many other people who have their phone taken, there was another frustration: he was able to track where his device went, but was powerless to get it back.

Phone pings around London

He put his iPhone 13 into lost mode when he got home an hour or so later – meaning the thieves couldn’t access its contents – and turned on the Find My iPhone feature using his laptop.

This allowed Akara to track his phone’s rough location and almost immediately he received a notification to say it was in Islington. Eight days later, the phone was pinging in different locations around north London again.

In a move says he “wouldn’t recommend” with hindsight, he went to two of the locations his phone had been in to “look around”.

“It was pretty risky,” he said. “I was fuelled by adrenaline and anger.”

He didn’t speak to anyone, but he felt he was being watched and went home.

“I am really angry,” he said. “The phone is expensive. We work hard to earn that money, to be able to buy the handset, and someone else says ‘screw that’.”

Then, in May, just over a month after the theft, Akara checked Find My iPhone again – his prized possession was now on the other side of the world – in Shenzhen, China.

Akara gave up.

It is not uncommon for stolen phones to end up in Shenzhen – where if devices can’t be unlocked and used again, they are disassembled for parts.

The city is home to 17.6 million people and is a big tech hub, sometimes referred to as China’s Silicon Valley.

Police could not help

In the moments after Akara’s phone was stolen, he saw police officers on the street and he told them what had happened. Officers, he said, were aware of thieves doing a “loop of the area” to steal phones, and he was encouraged to report the offence online, which he did.

A few days later, he was told by the Metropolitan Police via email the case was closed as “it is unlikely that we will be able to identify those responsible”.

Akara subsequently submitted the pictures and information he had gathered from the locations where his stolen phone had been. The police acknowledged receipt but took no further action.

The Metropolitan Police had no comment to make on Akara’s specific case, but said it was “targeting resources to hotspot areas, such as Westminster, Lambeth and Newham, with increased patrols and plain clothes officers which deter criminals and make officers more visibly available to members of the community”.

Lost photos of mum

Many other people have contacted the BBC with their experiences of having their phones taken. One, James O’Sullivan, 44, from Surrey, says he lost more than £25,000 when thieves used his stolen device’s Apple Pay service.

Meanwhile, Katie Ashworth, from Newcastle, explained her phone was snatched in a park along with her watch, and a debit card in the phone case.

“The saddest thing was that the phone contained the last photos I had of my mum on a walk before she got too unwell to really do anything – I would do anything to get those photos back,” the 36-year-old says.

Again, she says, there was a lack of action from the police.

“The police never even followed it up with me, despite my bank transactions showing exactly where the thieves went,” she said.

“The police just told me to check Facebook Marketplace and local second-hand shops like Cex.”

‘Battle against the clock’ for police

So why are the police seemingly unable to combat this offence – or recover stolen devices?

PC Mat Evans, who has led a team working on this kind of crime for over a decade within West Midlands Police, admitted that only “quite a low number” of phones that are stolen actually get recovered.

He says the problem is the speed with which criminals move.

“Phones will be offloaded to known fences within a couple of hours,” he said.

“It’s always a battle against the clock immediately following any of these crimes, but people should always report these things to the police, because if we don’t know that these crimes are taking place, we can’t investigate them.”

And sometimes just one arrest can make a difference.

“When we do catch these criminals, either in the act or after the fact, our crime rates tank,” he said.

“Quite often that individual has been responsible for a huge swathe of crime.”

But the problem is not just about policing.

In a statement, Commander Richard Smith from the National Police Chiefs’ Council, which brings together senior officers to help develop policing strategy, said it would “continue to target” the most prolific criminals.

“We know that we cannot arrest our way out of this problem,” he said.

“Manufacturers and the tech industry have an important role in reducing opportunities for criminals to benefit from the resale of stolen handsets.”

Tracking and disabling

PC Mat Evans

PC Mat EvansStolen phones can already be tracked and have their data erased through services such as “Find My iPhone” and “Find My Device”, from Android.

But policing minister Dame Diana Johnson said this week the government wanted manufacturers to ensure that any stolen phone could be permanently disabled to prevent it being sold second-hand.

Police chiefs will also be tasked with gathering more intelligence on who is stealing phones and where stolen devices end up.

A growing demand for second-hand phones, both in the UK and abroad, is believed to be a major driver behind the recent rise in thefts, the government said.

The Home Office is to host a summit at which tech companies and phone manufacturers will be asked to consider innovations that could help stop phones being traded illegally.

PC Evans said there was “no magic bullet”, but he said there was one thing manufacturers could do which would be “enormously helpful” to the police – more accurate tracking.

“At this moment in time, phone tracking is okay,” he said.

“But it’s not that scene in Total Recall yet, where you’re able to run around with a tracking device in your hand, sprinting down the road after a little bleeping dot.

“I appreciate it’s a big ask from the phone companies to make that a thing, but that would be enormously helpful from a policing perspective.”

Apple and Android did not provide the BBC with a statement, but Samsung said it was “working closely with key stakeholders and authorities on the issue of mobile phone theft and related crimes”.

Additional reporting by Tom Singleton

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History8 months ago

African History8 months agoBlack History Facts I had to Learn on My Own pt.6 📜

-

African History5 years ago

African History5 years agoA Closer Look: Afro-Mexicans 🇲🇽

-

African History1 year ago

African History1 year agoMajor African Tribes taken away during the Atlantic Slave Trade🌍 #slavetrade #africanamericanhistory

-

African History1 year ago

African History1 year agoCameroon 🇨🇲 World Cup History (1962-2022) #football #realmadrid #shorts

-

African History1 year ago

African History1 year agoWhat did Columbus Find in 1493? 🤯🔥🔥 #history #civilization #mesoamerica #africa #kemet

-

African History7 months ago

African History7 months agoBlack History Inventors: Mary Kenner 🩸

-

African History1 year ago

African History1 year agoOrigin Of ‘Cameroon’ 🇨🇲😳#africa